Cryptocurrency day traders are busy. They can’t always act on market volatility opportunities. Thankfully, there are many tools helping traders automate their trades. Take pending orders for example. Simply put, pending orders enable day traders to execute orders while they are away from their desks.

This guide will help you understand the basics of pending orders, and how they differ from other orders. Learn how to use pending orders in your day trading effectively.

Pending order definition

A pending order is an instruction that traders can input to execute automatically if certain conditions are met. Pending orders use slippage conditions, which is the difference between a price set by a trader and the price of a transaction. Slippage can be positive or negative. There are two main forms of pending orders:

- Stop orders.

- Limit orders

Traders can set multiple types of pending orders at once to make sure their strategy is well-rounded.

Stop Orders

These kinds of orders are placed at a market price lower than what the trader bought an asset at or negative slippage. In this case, the market trends either depreciate or stay the same.

Buy-Stop

Traders can use buy-stop orders to buy crypto at a higher price. In this scenario, the trader assumes that the crypto’s growth trend will continue after they purchase it. Thus, they’ll make a profit from the crypto as it becomes more valuable in their possession.

Sell-Stop

This pending order is to sell crypto if the price dips. Traders use a sell-stop order to minimize their losses in case crypto drops too low. For example, if the trader bought an asset for $100, they can place a stop order at $80. If the price continues dropping past $80, the trader will know they sold at a more profitable time.

Limit Orders

Traders place these orders with the expectation of rising market prices, or a trend reversal. To use either order, a day trader can make predictions on how crypto will break through resistance levels.

Buy-Limit

A buy-limit order is set to buy crypto at a price lower than the current one. In this case, the trader expects the price to rise again after purchase, ensuring a profit.

Sell-Limit

This pending order is set to sell an amount of crypto at an appreciated market price. Traders can use this order when they expect a cryptocurrency to rise to an estimated price, and then fall again. By selling their crypto before the price falls, the trader can turn a good profit.

Day trade definition

Day trading is a popular form of trading, in which people can buy and sell crypto online on the same day. This strategy is suitable for those who prefer to make gains by capitalizing on short-term price changes. By selling and buying multiple securities in just one day, traders can quickly add up their profits.

Traders can avoid the risk of holding positions overnight or long-term. They can also keep their portfolio diversified, and not risk their capital getting stuck in one security.

Suggested reading: How to Build a Diversified Crypto Portfolio

Still, day trading comes with its risks. The biggest is that more transactions can lead to more losses. Traders have to act very quickly to take advantage of short-term market changes. If they look away for an hour, they might lose out on a profitable movement. Day traders also might use borrowed capital to leverage their trades and buy more assets. They are at greater risk if they don’t realize enough returns to pay back loans in time.

Pending orders vs. market orders

As we’ve explained, traders can use pending orders to buy and sell their crypto securities. How are these orders any different from market orders? Traders can create a market order to buy or sell crypto immediately. Think of it like putting an ad on an online marketplace or store. You already have the item (crypto assets) and a set price for it (market price). You’ll trade the item as soon as you receive an offer for it. Market orders will most likely execute at or near the bid or asking price.

With pending orders, you’re setting up an instruction based on a certain condition. Whether the pending order is executed depends on if or when those market conditions are met. Traders can set pending orders for prices far above or below the current market price.

5 advantages of pending orders

There are many benefits to using pending orders while you day trade.

1. Make logical decisions

Emotions can get the best of us sometimes, especially during high-stress moments. When day trading, you often have to make snap decisions. If you’re swayed by your emotions – whether they be fear, excitement, greed or hope, you might make an irrational choice. With a pending order, you can set your entry and exit points for trade well in advance. You can also step away from monitoring your assets, allowing you to keep a clearer mind.

2. Time management

One of the best advantages of pending orders is how much time it saves. You can step away from the desk, leave the house, and even turn your computer off. A pending order will still execute automatically according to how you set it.

3. Block impulse decisions

Similar to the first point, day traders who have to make snap decisions might give in impulse. Trading in crypto requires discipline, and setting pending orders can help you stick to your plan.

4. Increases opportunities

Since you can set buy pending orders, you can open yourself up to more opportunities to enter the market. This means you can take advantage of market fluctuations no matter what the price level is.

5. Risk management

Traders often use pending orders to manage their risk and limit their losses. Traders can place pending orders to account for slippage in either direction. If the market moves against them, they can use a stop loss (stop-sell) order to sell the declining crypto. If it breaks through a resistance level and increases in price, they can place an order to sell and make a profit. Or, they can purchase more.

Pending order examples

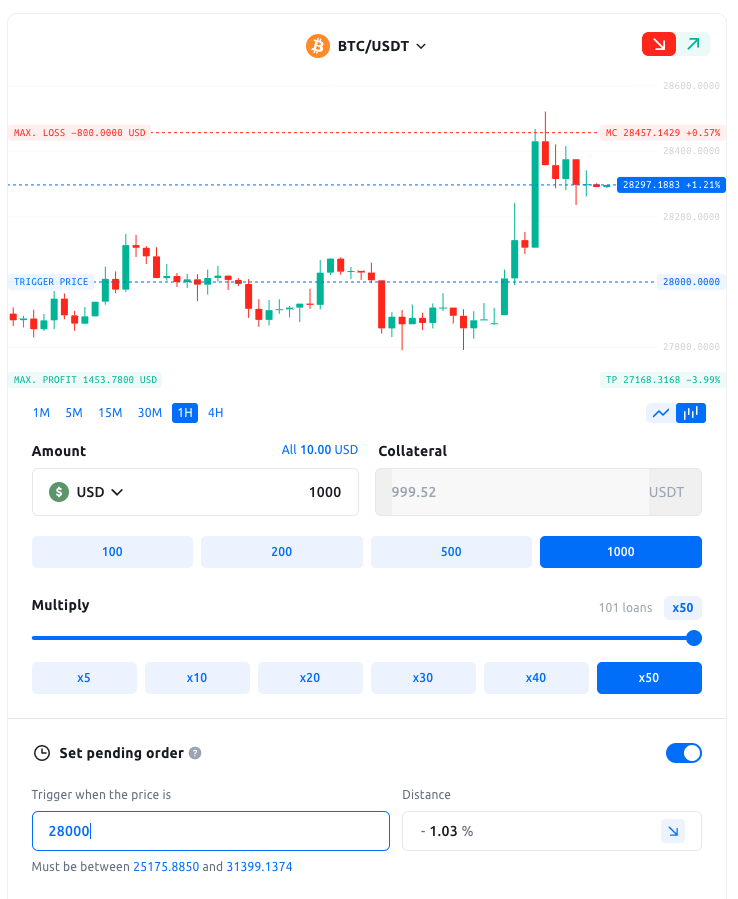

Let’s look at YouHodler for a real-life example of a pending order. On the YouHodler platform, the Pending Order feature is optional – allowing traders to set a “trigger price.” This trigger price executes the order when the price of a chosen asset reaches the trigger point.

In the pending order example below, the asset is Bitcoin (BTC) with a trigger price of $28,000. Since this particular order is set in the “down” direction, it means if BTC hits $28,000, a short position on Multi HODL will open automatically.

Instead of watching Bitcoin’s price every minute to see when it hits $28,000 this pending order allows you to plan your long and short positions ahead of time so they always execute when you need them to. Hence, this frees up additional time for day traders to make other trades or conduct research vital to their careers.

Disclaimer: The content should not be construed as investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is made available to you for information and/or education purposes only.

You should take independent investment advice from a professional in connection with, or independently research and verify any information that you find in the article and wish to rely upon.