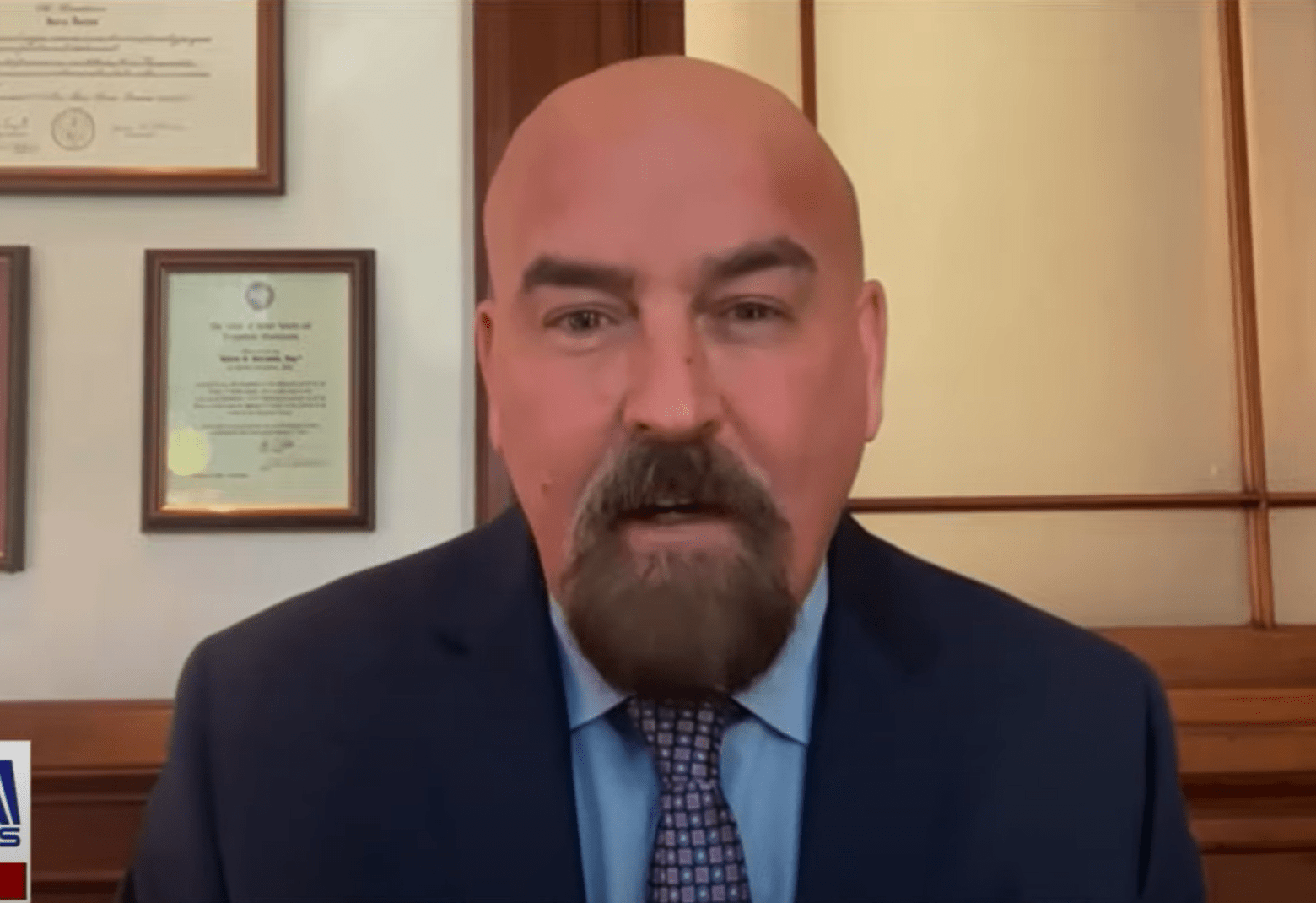

Pro-XRP lawyer John Deaton has publicly volunteered to testify at an upcoming congressional hearing on digital assets, financial technology, and inclusion. The hearing, scheduled for January 10, 2024, by the Digital Assets, Financial Technology, and Inclusion Subcommittee of the House Financial Services Committee, aims to examine the impact of the Financial Stability Oversight Council’s (FSOC) changing regulatory framework on innovation in the crypto sector.

Pro-XRP Lawyer Wants To Testify

Reacting to the announcement by the House Financial Services Committee Chairman Patrick McHenry, Deaton took to X (formerly Twitter), expressing his eagerness to represent the interests of individual token holders, distinguishing himself from advocates for crypto companies.

Deaton, with a track record of representing over 75,000 XRP holders as amicus curiae in the Ripple case, and his involvement in the LBRY case, stated, “If you want someone to testify who actually represents the interests of token holders – not crypto companies – and who has taken on the SEC and who’s helped expose just how much Gary Gensler does NOT protect investors – I volunteer my services.”

His offer received significant support from the XRP community, with responses urging Chairman McHenry to consider Deaton’s participation. The community views him as a credible and knowledgeable figure capable of articulating the impact of government regulations on retail crypto holders.

One user stated, “Come on Patrick McHenry do this as a parting gift. We have suffered long enough”. Another XRP community member added, “John Deaton is, by orders of magnitude, the most qualified, knowledgeable and credible individual to testify on the impact of government regulators’ impact on retail crypto holders.”

Deaton’s criticism of SEC Chairman Gary Gensler’s approach to investor protection is notable, especially in light of the SEC’s lawsuit against Coinbase. This paradoxical action by the SEC, as pointed out by Deaton, has raised questions within the crypto community about the regulator’s consistency and the protection of investor interests.

Furthermore, Deaton is pushing for a Congressional subpoena of SEC Chairman Gensler. On X, Deaton highlighted the lack of compliance from the SEC, urging public figures like Elizabeth Warren and Senator Sherrod Brown to uphold their responsibilities in overseeing the SEC’s actions.

“We don’t let up! Go to http://Crypto-Law.us and check out our real-time COUNTDOWN since Patrick McHenry threatened to issue a Congressional subpoena to Gary Gensler and the SEC due to his non-compliance. Hey Elizabeth Warren and Senator Sherrod Brown: This is what SEC oversight looks like. Since you two won’t do your job, private citizens will hold you accountable,” Deaton stated on X.

Why It Is Important

Scheduled for January 10, 2024, the hearing titled “Regulatory Whiplash: Examining the Impact of FSOC’s Ever-Changing Designation Framework on Innovation” aims to address risks associated with cryptocurrencies, emphasizing the need for regulation of crypto spot markets and stablecoins. The hearing is expected to delve into these issues and more, potentially shaping the future of cryptocurrency regulation and innovation.

Deaton’s potential testimony at the hearing could provide valuable insights from the perspective of cryptocurrency holders, a group often overlooked in regulatory discussions. His experience and outspoken stance on these matters could contribute significantly to the understanding of the complex interplay between innovation, regulation, and investor protection in the digital asset space. However, McHenry has not yet responded to Deaton’s offer.

At press time, XRP traded at $0.57993.

Featured image from YouTube / CryptoLaw, chart from TradingView.com