Since Bitcoin first entered the world 13 years ago with its decentralized, distributed ledger technology, the finance industry has faced an existential crisis. The definition of what a bank is and what it can do is no longer clear. Instead, it’s open-ended and filled with limitless possibilities. This is especially true with the coming of Web 3.0 or simply, Web3.

As we speak, the evolutionary forces of technology are reshaping finance for the better. Creating a new brand of “Web3 finance” that connects the old world with the new, offering enhanced financial services for anyone with a smartphone.

Situated at the forefront of this movement is YouHodler. The trendsetting team has worked on this concept since 2018. Now, CEO Ilya Volkov sits down with us to describe his vision of the past, present, and future, giving us a clear definition of what exactly Web3 finance looks like.

Interview with YouHodler CEO about Web3 Finance

Q: Let’s first talk about the evolution of Bitcoin and cryptocurrency. As of 2022, estimates put global cryptocurrency ownership at an average of 4.2%. That’s over 320 million crypto users around the world. Do you think the “crypto revolution” is over?

A: First of all, I don’t think it is a revolution. In my mind crypto is just a logical evolutionary step in the development of Finance Technology. I think the cryptocurrency evolution is far from over. You might say “well the adoption rate is only 4.2%.” Well, I say “the adoption rate is only 4.2%.” See what I mean? It is in fact an inevitable EVOLUTION of finance, and we are ready for it!

Let’s go back to Bitcoin. Bitcoin set out to disrupt fiat currency. That was the initial goal and so far, it’s succeeding. Since then, we’ve had thousands of Bitcoin copycats and a few innovative new cryptocurrencies as well. The original DNA of Bitcoin is out there across the world, in many forms.

Sure, that’s great. However, we are still using fiat currency every day.

So what’s next? What will keep driving this financial evolution? For me, I think the bridge between traditional finance and “new finance” is the next big driving factor.

Q: So you are saying, crypto cannot evolve until this bridge is built? Who will build it and how?

A: We’re building it right now! The key components of building this bridge are respect and simplicity.

What I mean by respect is we need to pay respect to the great technologies and traditions of the past. There is a reason they are still popular today. They have a strong purpose in society.

I know many great minds in the crypto world that want to burn bridges from TradFi to CeFi/DeFi. They want to destroy the old establishments and start fresh. I disagree.

There are several great, beneficial financial services in the traditional world.

I want to bring these services over to Web3. To do this, we will build smooth and easy-to-use bridges.

That’s where the simplicity element comes in. To truly make this a successful endeavor, we need to simplify everything so it’s intuitive and “people-centric.”

We are not only making crypto for everyone but finance for everyone.

Q: Alright, so you’re building a bridge from Traditional Finance, and at the end of this bridge is…a Web3 finance? What is a “Web3 financial institution” exactly?

A: As I said before, our paper cash is still here. It’s not going away because it still has major use cases. The only way to have total control over your funds in the traditional world is to use paper cash.

Simultaneously, if you want to make your money work for you, then you still need the help of banks and financial institutions. The same goes for cryptocurrency.

If you want to take full control over your funds, and not miss out on early Web 3.0 adoption, use a decentralized non-custodial wallet – “your keys, your crypto”. At the same time if you want to benefit from crypto-lending, trading, smooth crypto-to-fiat conversions, and other CeFi services – why not use crypto-financial institutions?

I thought to myself,

“why isn’t there anything out there that lets us harness the benefits from both worlds all in one place?”

I mean both from fiat and crypto worlds as well as from Web 2 and Web 3 – where Web 3 is decentralization.

That’s where the “Web3 financial institution” comes in.

A Web3 financial institution doesn’t ignore fiat currency or cryptocurrency. Nor does it ignore decentralized or centralized services with clear added value. Instead, it allows you to use services from both sides. This includes:

- Centralized wallets with both crypto and fiat on them as well as Web 3.0. Wallets that allow you to benefit from decentralization.

- Investment services from both worlds: crypto staking, traditional bonds, and other financial instruments.

- A complete 360-degree payment and trading service.

Q: That’s a creative idea. Where did you get the inspiration for this?

A: There is a great quote from Steve Jobs I remember. He used to say:

“creativity is just connecting things.”

This is the birth of innovation. It is not inventing a new concept out of thin air.

Instead, it’s being alert to the products and services that we already have and combining them in new ways to build something unique. Many times, the answers are right there in front of us.

Usually, people don’t even know what they want until we show them.

To use Jobs as an example again, think about when the first iPhone came out. Everyone wanted one. However, before it was invented, no one could describe an iPhone as what they wanted.

I feel the same can be said about a Web3 financial institution. It’s all right there. People want it and need it. They just don’t know it yet. I want YouHodler to be the first to present it to them.

Q: Let’s talk specifics now. What will YouHodler’s “Web3 financial institution” look like?

A: To put it simply, it will comprise the following elements:

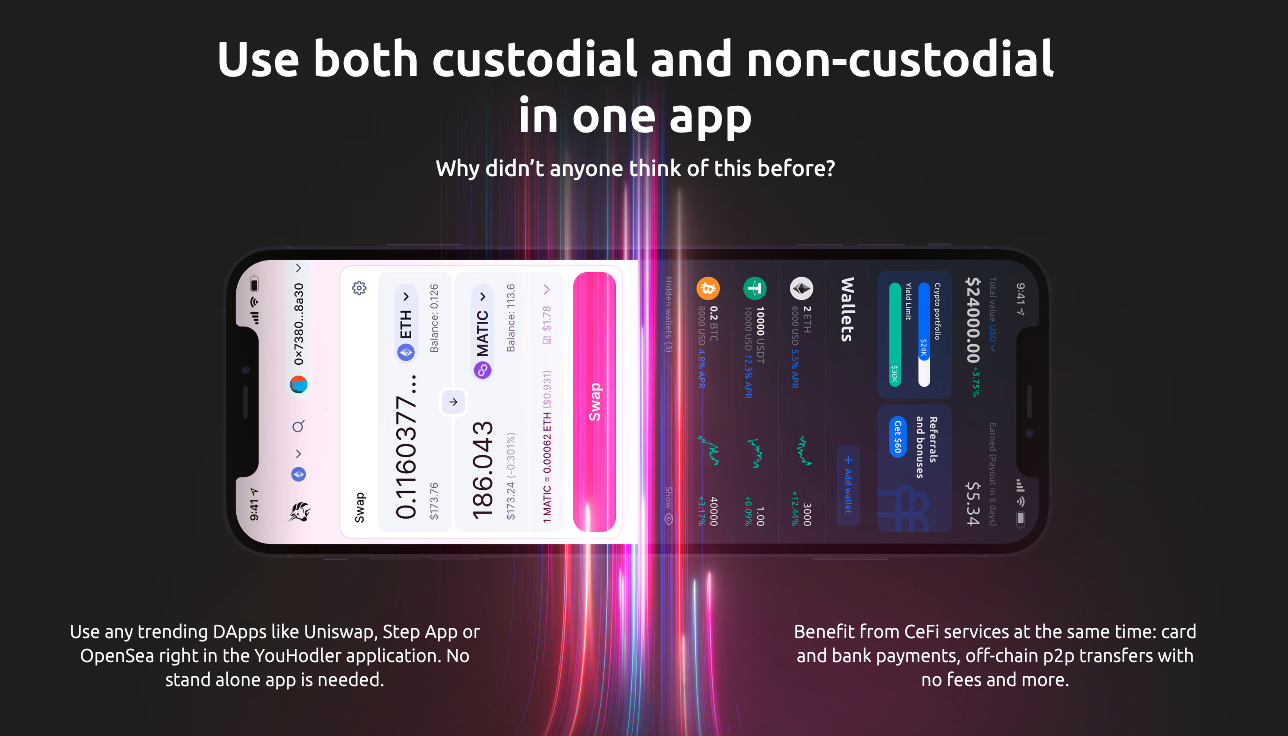

- Custodial and Non-Custodial wallets in one single application.

- Physical credit cards allow for easy use of both fiat currency and cryptocurrency.

- Full payment capabilities with any currency.

- Traditional services such as loans, savings accounts, and currency exchange.

- Financial services like on-chain staking and traditional bonds investment,

- And of course the industry’s best asset trading.

Again, I believe that a combination of fiat and crypto, DeFi, and CeFi has great potential. How? A simple example is this.

To get stable returns, you can and should use traditional instruments like bonds. However, if you want to earn more, then you should experiment with crypto.

Crypto staking and trading can bring you much higher returns. Is it risky? Yes. However, with a cautious risk-management approach, a combination of TradFi and crypto can open up more opportunities than traditional finance alone.

Those are the benefits of both worlds. They already exist but not in one simple application. We’re changing that.

Q: And how is this different from your competitors?

A: YouHodler doesn’t have a true competitor. Our Web3 concept is vastly different from what everyone else is doing. Think about it.

Have you ever heard of a custodial and non-custodial wallet in one app? It’s a rare concept that is only just beginning. It will be a key aspect of our app that is going to drive this evolution.

Our competitors do some of the things we do like lending or staking for example. However, the key difference is that we are doing it all in one place.

CeFi, DeFi, TradFi, fiat, and crypto. It’s all here and it’s all on our app.

Q: Let’s talk more about the word “bank.” Is YouHodler a bank and do you have a banking license?

A: No. We are not a bank in the technical sense of the word. YouHodler is a finance technology company currently building the concept of a “Web 3 Financial Institution” and in this way, again, we’re doing our best to combine the benefits of both worlds: traditional and crypto licenses.

Crypto and FinTech in general both still have one major problem:

the market operates globally but is regulated locally.

We’re resolving this issue through a combination of different licenses and partnerships.

To put it simply:

- We provide some traditional services, like traditional payments in partnership with traditional financial institutions, and traditional investment product offerings will be provided via partnerships. Partnerships such as this will help us build bridges faster.

- We identify as a Swiss financial intermediary surrounded by locally regulated CASPs (Crypto (Digital or Virtual) Assets Service Providers).

- Switzerland is the center and we are building branches of other entities throughout Europe.

- We have already established local entities of subsidiaries in Italy, and France, and we are registering our Swiss entity directly in Spain with more plans to expand.

Furthermore, we have a few more license applications in progress. This will further help us complete these bridges between Web2 and Web3.

Q: These are very bold goals. Do you have a timeline for them?

A: Yes they are ambitious goals. But I’m a firm believer that we must always keep pushing if we want to innovate. As for the timeline, we have several of these features already on our platform. Crypto-backed loans, crypto-rewards accounts, crypto trading, dual crypto-currency investment, and crypto-currency conversion, major payment solutions are up and running.

As for the non-custodial wallet, physical credit cards, and on-chain staking, those will come soon. Implementation is planned for 2023. For the rest of 2022, we will focus on optimizing our current products and testing.

Q: I heard rumors of a YouHodler token coming soon. Any comments?

A: We are considering a YouHodler token at the moment. Its development is not final but we will keep the community posted regarding our decision.

Q: You said you have no competitors earlier, but a few days ago, Binance said in an article they are looking to buy a bank and “bridge the gap” between crypto and traditional finance. That sounds familiar, doesn’t it?

A: I don’t see this as a negative event or even competition. If one of the world’s largest crypto exchanges shares the same sentiment as YouHodler, then it means we are doing something right.

Since day one, YouHodler sets trends. We’re constantly ahead of the curve because we listen to what people want. We build tools for people to use. That’s how we view ourselves.

We just enjoy building great stuff. We follow big trends. We build cool things we think are valuable.

The YouHodler brand and community have taken on a life of their own. It’s out there and it’s generating strong reactions from people. That’s why we see people following our trend all the time. We have faith in people and because of that, we make technology for people.

Q: Thank you for your time Ilya. Any last comments?

A: You can pre-register for our web3 financial solutions at the link below! On a more serious note though, I want to go back to your first question about Bitcoin in 2009. Since then, the world is clearly a better place.

People now have access to certain services that only small groups of wealthy individuals had before. There is more opportunity than ever before. Bitcoin has given people powerful tools to change their financial situation. That trend is only going to continue.

As always, YouHodler is going to be at the forefront of that trend. Right now, that trend is Web3 and Web3 Finance starts with us.