This week, eleven spot Bitcoin ETFs were approved after months of speculation and waiting, bringing BTC to mainstream institutions for the first time. With BTC often considered digital Gold considering its finite supply, could the top cryptocurrency by market cap see a similar 360% post-ETF launch rally following in the footsteps of SPDR Gold Shares – the first gold-backed ETF launched in 2004?

Gold Rallied 360% After ETF Launch

At the moment, it still isn’t clear if the Bitcoin ETF approvals were a “sell the news event” or if it is a catalyst for further rally. However, considering the potential for billions of dollars in inflows into these newly launched funds combined with the fact BTC is the most scarce asset in human history, price appreciation seems to be a given eventually.

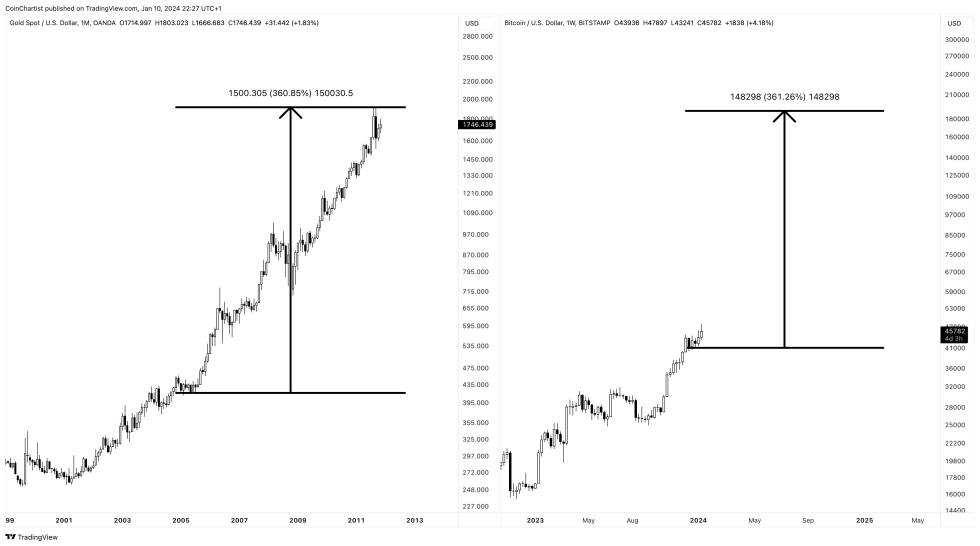

The best gauge of how Bitcoin might perform could come from the precious metal that Satoshi Nakamoto saw beneficial attributes in, such as a limited supply. In 2004, the first Gold-backed ETF was launched on the New York Stock Exchange: SPDR Gold Shares. In the years that followed, the underlying asset – Gold itself – climbed by more than 360% before finding a peak.

A 360% rally from current levels in BTCUSD, would propel the largest cryptocurrency by market cap to more than $200,000 per coin. However, there is more to this comparison.

Gold after ETF launch versus BTC now | BTCUSD on TradingView.com

Why Bitcoin Could Break All Records

While SPDR Gold Shares and what’s going on with Bitcoin make for an interesting comparison, the crypto-centric ETF is already enjoying a lot more success. Spot BTC ETFs debuted with more than $3 billion in trading volume, making it the most successful ETF launch in history.

Unlike Gold, which more could be mined at any given moment, Bitcoin has a truly finite supply with a hard cap of 21 million BTC. Even less is in circulation, with millions more potentially lost or locked away forever. Furthermore, more than 50% of the BTC supply hasn’t moved in two years, even during one of the worst bear markets on record, risk of a recession, potential for World War, and more.

All of these factors make Bitcoin especially poised for longer-term price appreciation – a fact that institutions are aware of considering the cryptocurrency’s risk versus reward profile.