Bitcoin is down a hefty 12% following the highs placed after the US SEC approved the first spot Bitcoin ETFs to go live on US financial markets last week.

The anticipation for the ETF approval caused traders to front-run the event, helping prices drive as high as $48,000 in the process.

With the event behind us, traders are wondering where the next direction is for the market, and a short-term range has emerged that will dictate the next move.

Traders are also wondering if they should enter here or look for opportunities elsewhere that provide higher returns, with Bitcoin Minetrix ($BTCMTX) appearing as one of the strongest options.

Bitcoin Falls 12% From Peak After SEC ETF Approval.

Bitcoin underwent a monumental event last week after the US SEC approved 11 Bitcoin spot ETFs to go live on the market.

The ETFs mark a major milestone in the history of digital assets as they open doors for institutions to invest in cryptocurrency through a compliant vehicle.

With the ETFs now live, institutions can pitch $BTC as a potential investment to their wealthy clientele.

Unfortunately, the markets haven’t reacted as everybody suspected they would, with Bitcoin falling a steep 12% from the $49,050 high set on January 11, 2024.

The cryptocurrency managed to surge to this high following the announcement, allowing it to break above the 2022 highs at $48,285.

However, it quickly rolled over from there and headed lower;

During the price pullback, Bitcoin broke beneath the 20-day and 50-day MAs and fell below a long-term rising trend line.

It is now battling support at $41,720 as it attempts to remain bullish, with a clear range appearing to dictate the next direction.

Bitcoin Range That Dictates Next Price Movement

On the shorter time frames, $BTC has established a solid range that can dictate the next direction in the market.

The upper angle of the range lies at $42,260, with the lower angle at $41,705;

A break above the range would allow $BTC to attempt last week’s highs of around $47,000.

Alternatively, a break beneath the range would see Bitcoin battling to hold above $40,000 as it reverses the previous bullish narrative.

With the range being so tight, it will likely break out in the coming 48 hours.

What Alternatives Can Provide Better Opportunities?

While Bitcoin sees a temporary pullback, traders seek alternatives that can provide better opportunities with higher returns.

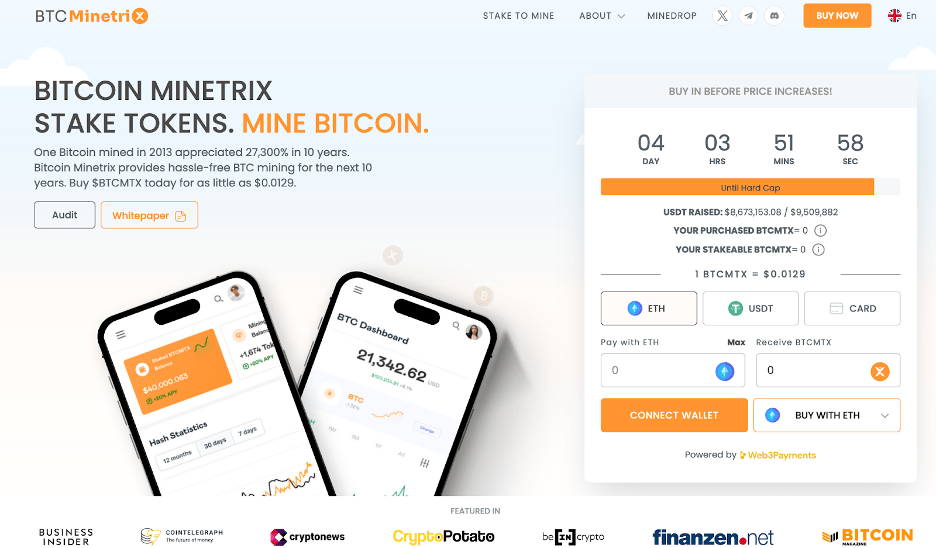

In particular, Bitcoin Minetrix ($BTCMTX) continues to turn heads in this regard after raising an impressive $8.6 million in its presale.

Traders are rushing to get positioned in this stake-to-mine cloud mining platform, as they believe it can 10x with the Bitcoin block halving just 100 days away.

Bitcoin Minetrix Raises Astonishing $8.6 Million in Presale.

Bitcoin MInetrix ($BTCMTX) has raised an astonishing $8.6 million in its presale as investors flock to the stake-to-mine ecosystem.

Bitcoin Minetrix is a decentralized cloud mining solution introducing a novel stake-to-mine concept that helps everyday users mine Bitcoin.

It stands apart from the traditional centralized cloud mining services as it doesn’t require users to sign up for long-term mining contracts.

Furthermore, as all user allocations are automatically managed by audited smart contracts, miners will never be left short on their expected earnings.

Bitcoin Minetrix aims to transform the cloud mining sector ahead of the next Bitcoin block halving through tokenization.

Miners simply have to buy and stake their $BTCMTX tokens to earn Mining Credits, which can be burnt in exchange for time on the cloud mining platform.

Tokenization helps remove all the mining scams prevalent in the current centralized cloud mining service today.

The staking adds another revenue stream alongside mining returns, with stakers currently earning a respectable 75% APY.

Those interested in buying $BTCMTX can purchase it on presale for $0.0129. However, with the presale using a rising pricing strategy, those getting positioned earlier benefit from the lower entry prices.

Overall, with the Bitcoin block halving less than 100 days away, it’s clear that investors are backing $BTCMTX as a disruptive force in the mining space and might be one of the most important infrastructure projects following the halving. Investors expect anywhere between a 10x and a 50x return on this project following the Bitcoin block halving.