In a post on X, analyst Cardano Yoda believes that a USD-pegged stablecoin is crucial for ADA’s future success, suggesting that its integration could trigger a bull run sometime in 2025.

A stablecoin, a token that’s “stable” since its price is pegged to a fiat currency like the USD or Euro, will ignite activity, driving decentralized finance (DeFi) and even non-fungible token (NFT) activities even higher. With a popular stablecoin like USDT or USDC deployed on the proof-of-stake blockchain, the number of users interacting with Cardano dapps will likely spike, catalyzing demand since ADA is used for paying fees.

Stablecoins, Input Endorsers, And Hydra Might Prop Up Cardano In The Long-Term

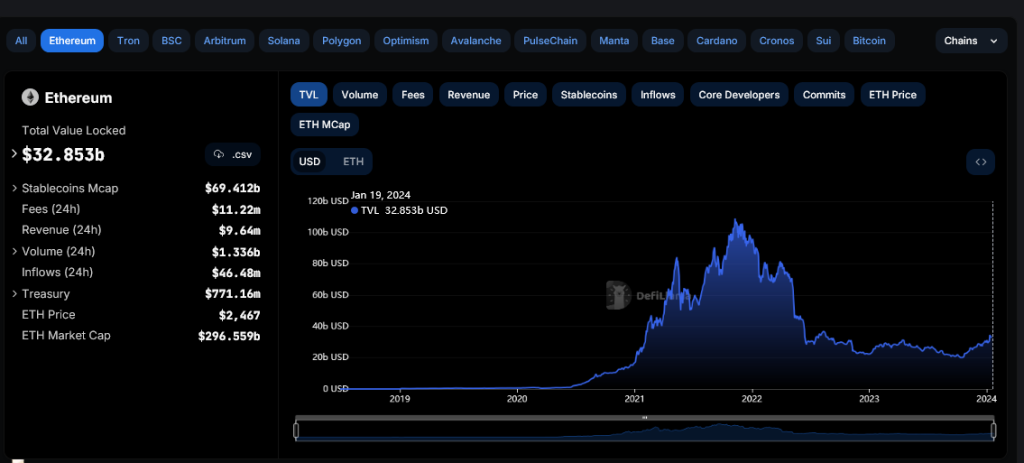

The presence of a high market cap stablecoin can facilitate seamless value transfers and reduce volatility. Already, networks like Ethereum, Tron, and Solana have been more active as billions of stablecoins like USDT, USDC, USDD, and even DAI are minted by network users. For this reason, their respective DeFi and NFT ecosystems command higher total value locked (TVL) with individual protocols managing billions of dollars.

To illustrate, DeFiLlama data shows that Ethereum and Solana DeFi ecosystems have TVL of $32 billion and $1.3 billion, respectively. Meanwhile, though improving, Cardano has a TVL of $337 million. For context, one of Ethereum’s largest DeFi protocols facilitating stablecoin exchange, Curve, manages over $1.6 billion in TVL.

Beyond stablecoins, the analyst also emphasized the current development of Input Endorsers and the eventual deployment of Hydra. In the Basho stage, Cardano’s lead developer, IOG, continues to refine the network. One critical development to improve performance is Input Endorsers. This feature further enhances on-chain scalability and transaction processing speeds by introducing a parallel validation process, effectively removing bottlenecks.

On the other hand, Input Endorsers will be complemented by Hydra, an off-chain scaling solution similar to Ethereum’s approach with layer-2s. Through Hydra, IOG said Cardano will scale horizontally while remaining secure and decentralized.

Becoming Cross-Chain, Will ADA Find Support At $0.50

These moves could support ADA prices in the days ahead. Already, Cardano is looking to expand its ecosystem. In November 2023, it partnered with Polkadot, a cross-chain platform.

This partnership will provide a means for seamless communication and asset transfers. At the same time, the resulting interconnectedness and interoperability may further drive adoption, boosting the two ecosystems.

So far, ADA is steady, finding support at around the $0.50 area. Technically, the uptrend remains. However, for the breakout above the current bull flag, there must be a sharp move up above $0.55 with increasing trading volume.

Feature image from Canva, chart from TradingView