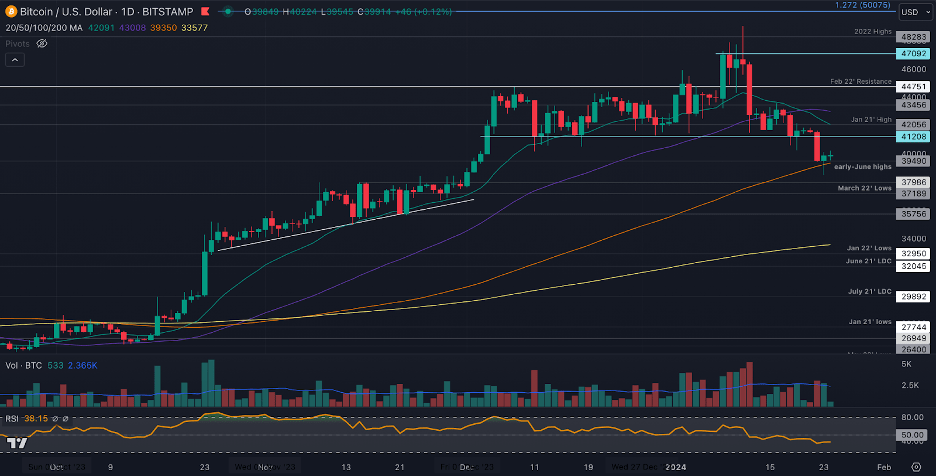

Bitcoin rebounded from the 100-day MA earlier this week as the bulls battle to defend the crucial support to prevent further declines.

The cryptocurrency is now down 20% from the 2024 highs set following the SEC’s approval of eleven Bitcoin spot ETFs on US financial markets.

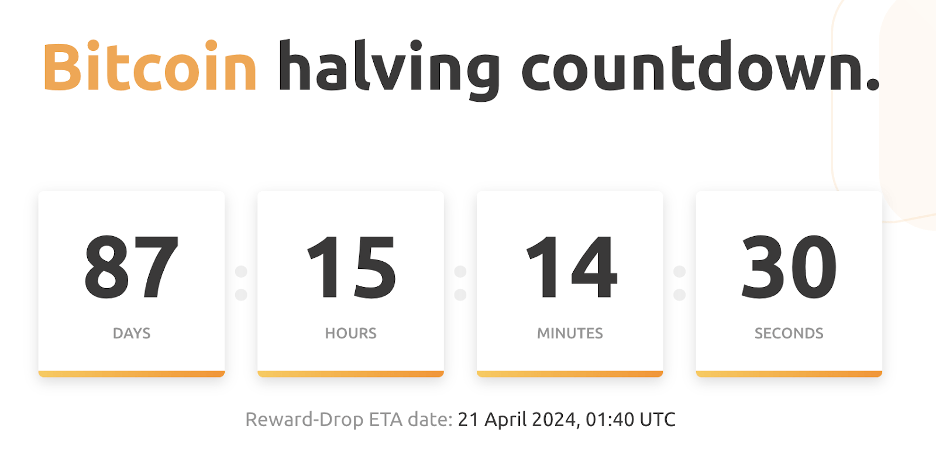

Traders are still bullish on the future outlook of Bitcoin, with the block halving scheduled within the next ninety days.

With the major bullish catalyst incoming, investors continue accumulating Bitcoin and other mining-related projects that can potentially provide 10x returns.

Bitcoin Sees 20% Price Fall Following SEC Bitcoin ETF Approval.

Bitcoin is down by a steep 20% from the highs set following the introduction of Bitcoin spot ETFs on US markets.

The number-one-ranked cryptocurrency had surged as high as $49,000 following the announcement but quickly rolled over and started to fall.

Earlier this week, Bitcoin fell beneath solid support at $41,200, causing it to dip below $40,000 and land at the 100-day MA level;

The bulls are now fighting to defend this support as a break beneath the level could see Bitcoin heading as low as $34,000.

If the sellers push below the 100-day MA, the first support toward the downside lies at $38,000 (March 2022 lows). This is followed by support at $37,200, $35,750, and $34,000 (200-day MA).

On the other side, the first resistance above lies at $40,000. This is followed by $41,200, $42,000, $43,400 (50-day MA), and $44,750.

Is Bitcoin Still Bullish?

Despite the pullback, investors agree that Bitcoin will remain bullish over the next few months due to the upcoming Bitcoin block halving.

The block-halving event has historically been a major bullish catalyst in the market, sparking every bullish run witnessed in the industry’s history.

The event is expected to take place within the next ninety days, and traders are keen for any dips to buy to accumulate more $BTC.

The block halving event will see the block reward slashed by 50% as miners earn 3.125 BTC per block, down from 6.5 BTC.

What Alternative Projects Are Better Options With The Halving Coming?

While Bitcoin leads the race for the safest gains during the block halving, investors are also turning their attention to newly emerging alternatives that have the potential to provide much higher returns for small investments.

In particular, investors are focusing on alternative mining projects that will directly benefit from the Bitcoin block halving event.

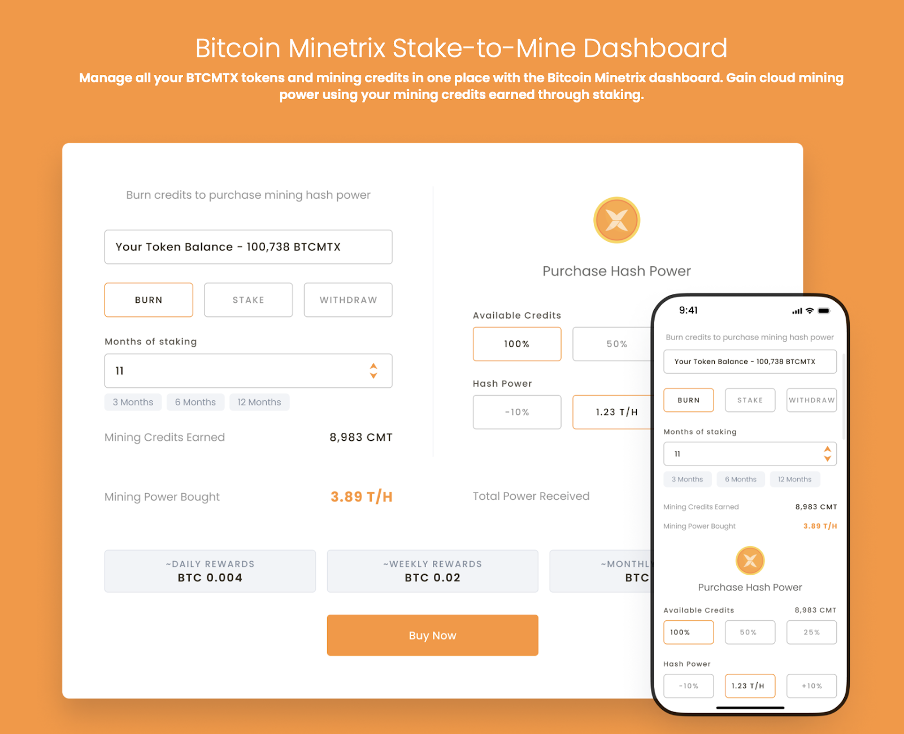

One project that continues turning heads is Bitcoin Minetrix ($BTCMTX), which recently crossed an astonishing $9 million in fundraising as investors rush to its stake-to-mine solution.

Bitcoin Minetrix Raises $9 Million As Investors Seek Decentralized Mining Solution.

Bitcoin Minetrix ($BTCMTX) officially crossed the impressive $9 million milestone this week as investors rush to its decentralized mining solution.

Bitcoin Minetrix seeks to change the cloud mining landscape ahead of the next Bitcoin block halving through its novel stake-to-mine mechanism.

The project allows everyday users to mine Bitcoin through a safe and secure Bitcoin cloud mining platform.

Cloud mining isn’t a new service in the crypto sector. It allows users to mine Bitcoin by renting hashing power from dedicated mining centers without buying or maintaining expensive mining hardware.

However, today’s centralized solutions often cheat users by locking them into long-term mining contracts and leaving them short on expected earnings.

Bitcoin Minetrix intends to change this dynamic through tokenization.

Users can buy and stake $BTCMTX tokens to earn Mining Credits, which can be burnt in exchange for time on the Bitcoin Minetrix mining solution.

Tokenizing the process ensures miners stay in control of their funds, and the audited smart contracts allocate user earnings, so miners earn precisely what they are owed.

Given its impressive fundraising, investors are clearly backing Bitcoin Minetrix as a disruptive force in the industry.

Prominent influences like Zack Humphries and Michael Wrubel have endorsed the novel stake-to-mine infrastructure for Bitcoin Minetrix, lending their credibility to the project.

$BTCMTX can currently be purchased in the presale for $0.013.

A rising pricing strategy causes the price of $BTCMTX to rise through the presale stages, so those getting positioned earliest benefit the most from the lower prices.

Overall, Bitcoin Minetrix is one of the hottest alternative options ahead of the Bitcoin block-halving event that can provide outsized returns.