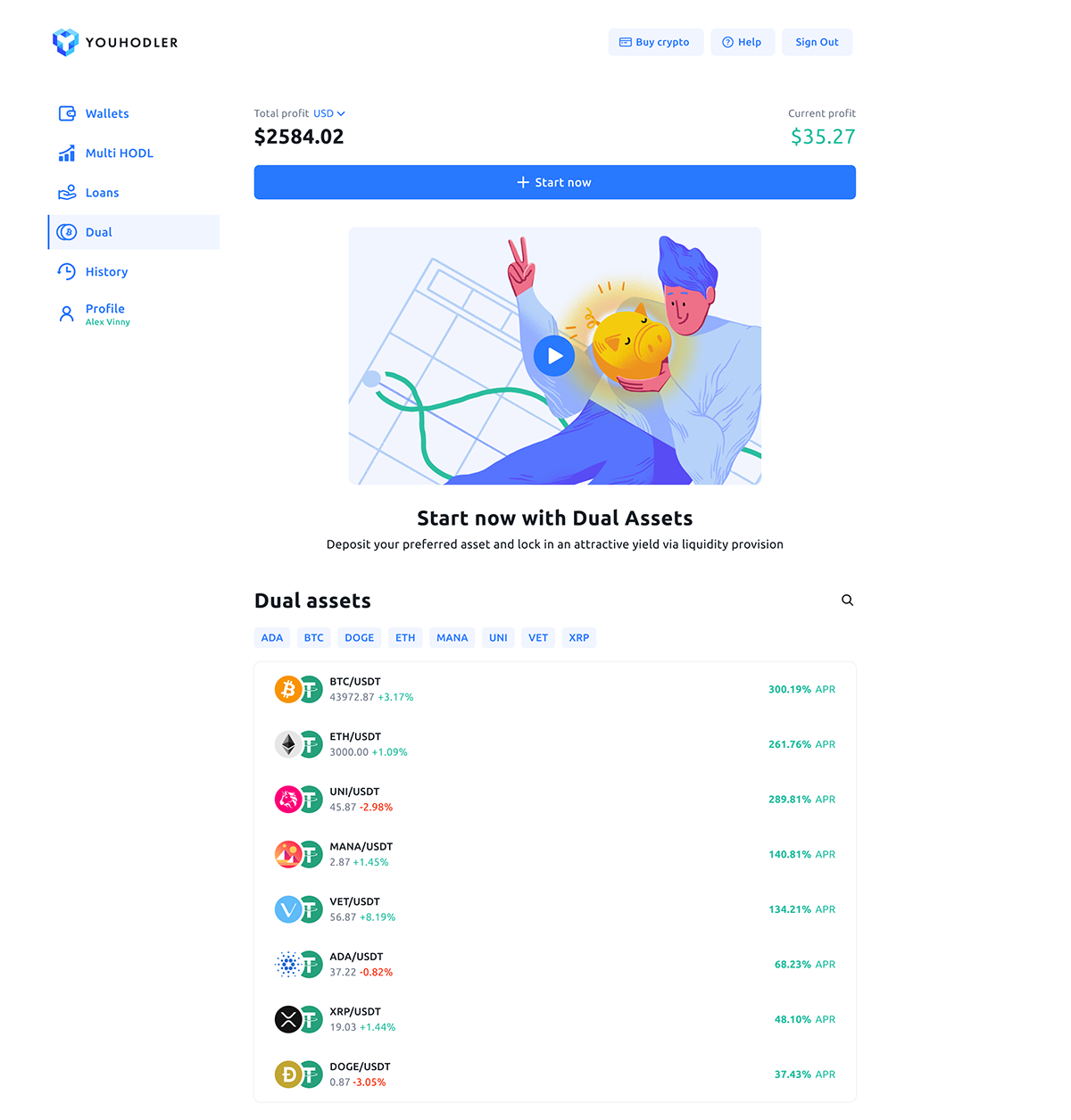

In our constant bid to bridge the gap between traditional finance and cryptocurrency, YouHodler is pleased to announce a new yield generation product. “Dual Assets” combines the high yield generation strategies from decentralized finance (DeFi) with the simplicity of traditional FinTech platforms. The result is an easy-to-use wealth management product for everybody with returns as high as 365%.

What is Dual Assets and how does it work?

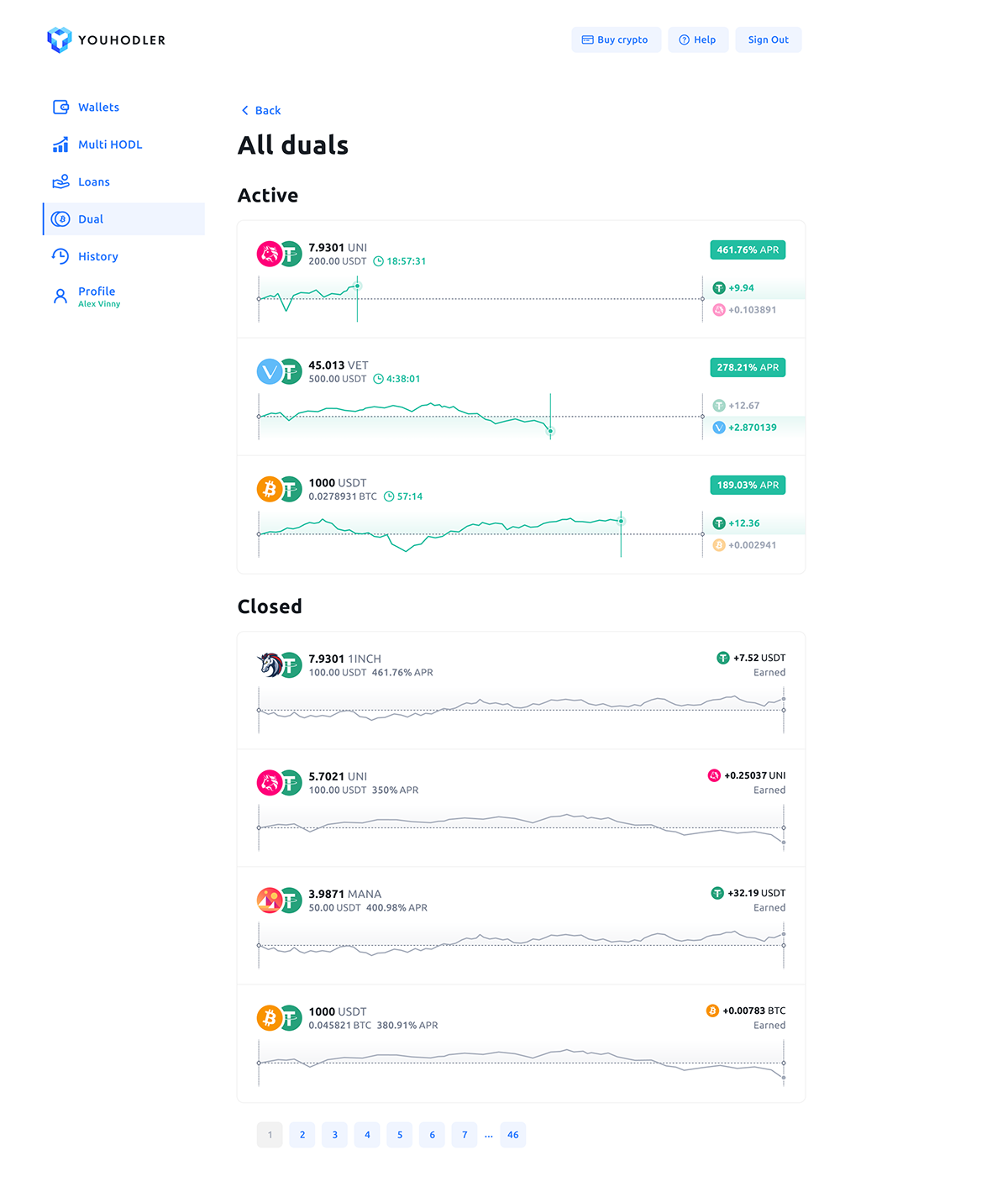

As the name suggests, Dual Assets involve linking two assets — one cryptocurrency asset and one stablecoin. This gives the user and the market a chance to earn a larger yield based on predicting an asset’s future growth potential. This product is ideal for crypto holders who want to manage their risk more effectively while generating more yield than traditional “hodling” techniques.

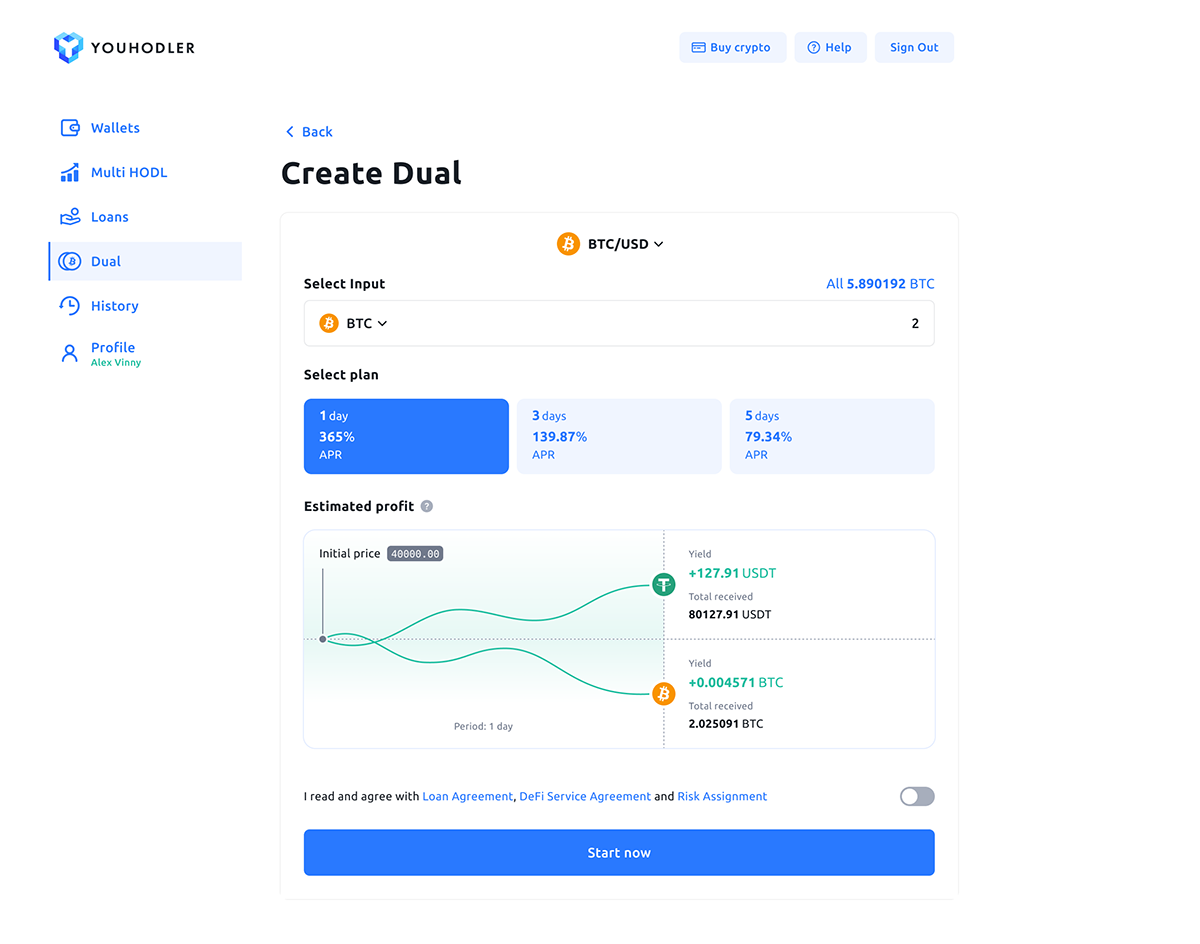

In short, the mechanics behind Dual Asset comprises three main steps. Let’s see how it works in an example. For this, let’s assume Ethereum (ETH) is trading at USD 1,500 for the ETH/USDT pair.

Step 1: Choose the ETH/USDT pair from the assets list

Step 2: Open a stake with 1 ETH (or 1,500 USDT) as an input coin

Step 3: Select a plan (e.g. 1 day with 365% APR) and click Start

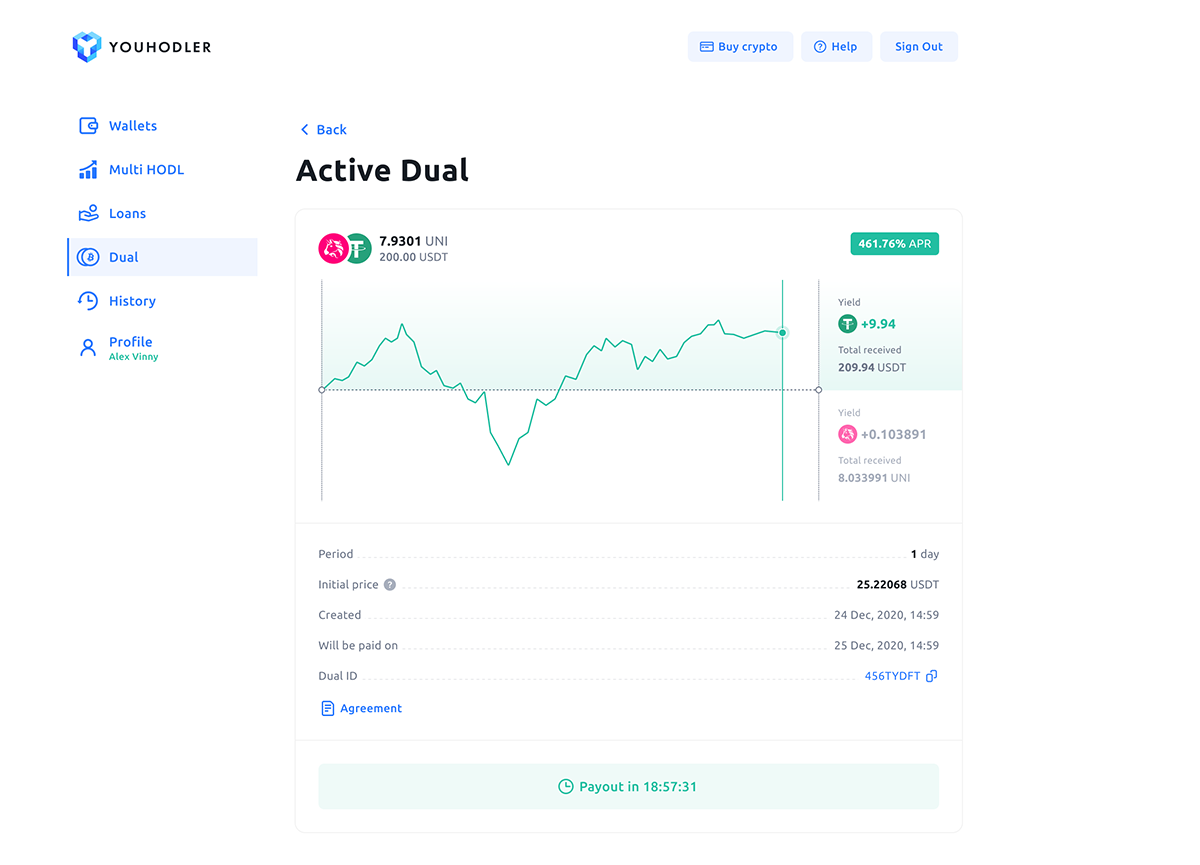

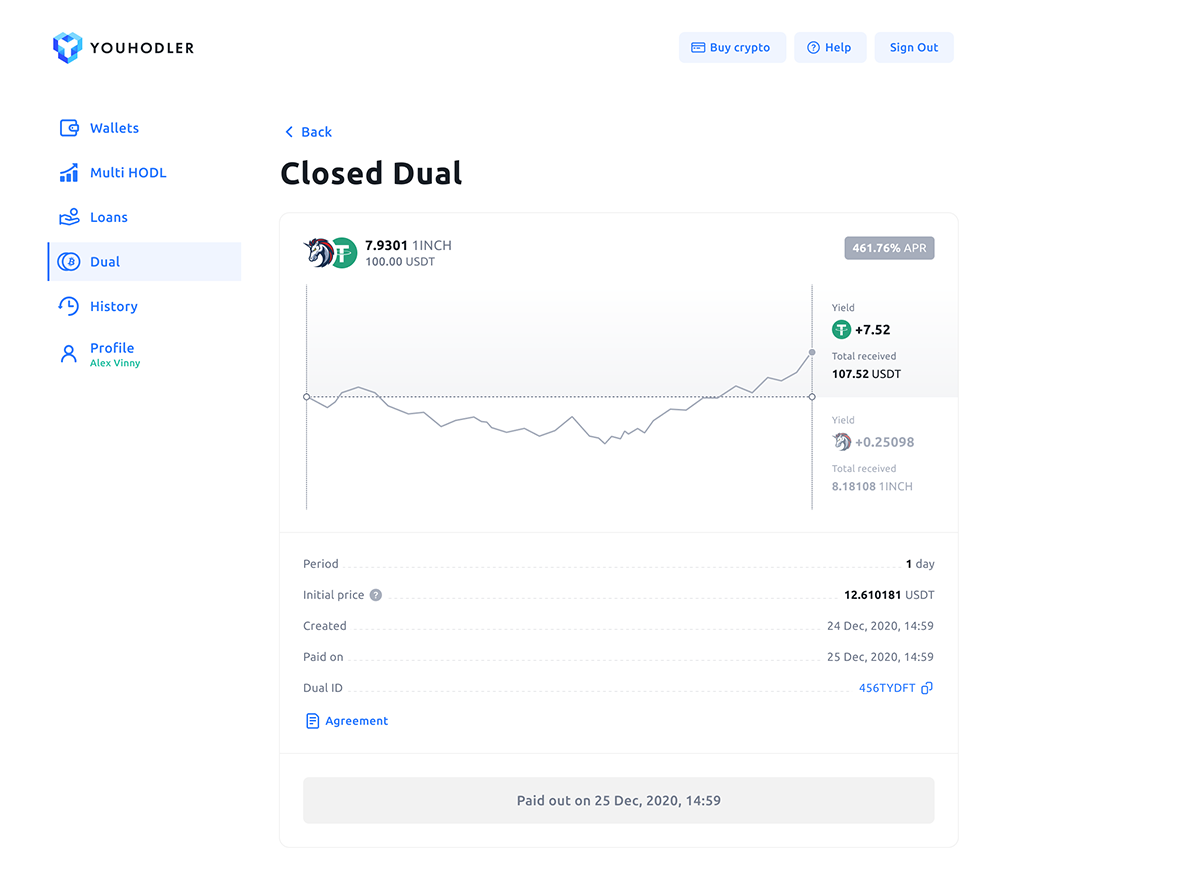

Looking at the initial price and duration, YouHodler then arbitrates the annualized yield range in ETH. When the duration of your plan is over, the settlement price is compared to the initial price. This determines whether you get paid back in either ETH or USDT.

- If ETH settles above the initial price at the end of the duration, then you get back your initial investment plus the extra yield paid in USDT generated during the length of your plan.

- If ETH settles below the initial price, you get back your initial investment plus the extra yield generated on ETH during the length of your plan. While it might seem like getting paid in a currency that just decreased in value is a loss, this could easily become profitable later when ETH rises in value once again.

Bonus tip! – expand your savings limit by using Dual Assets

If you open a Dual Asset deal, your wallet savings limit automatically increases for one week. For example, if you take $10,000 to use with the Dual feature, your savings limit will increase not once, but two times. Your savings limit will increase an additional $10,000 at the start of the deal and then another $10,000 at the end of the deal and will last for one week. After that, the savings limit returns to its default amount.

Dual Assets vs. conventional “Hodling” methods

Dual Asset is more beneficial than conventional “hodling” methods for various reasons. These are as follows:

1. “Activating” your crypto makes it work for you

When storing crypto in a hardware wallet, you get 0% in return — aside from the natural growth of that asset in the market. When you “activate” your crypto on YouHodler, you benefit from the asset’s natural price growth in addition to generating more yield with our Dual Assets feature.

2. You profit regardless of the market situation

If you HODL, you only profit in bull markets. Dual Assets, however, lets you generate a positive yield regardless of the market situation. The only risk involved is that you receive less profit if the price of your crypto should grow at a dramatic rate during the duration of your Dual Assets deal. Of course, this all depends on how you select your linked price at the time of creation.

3. It’s easy to use

To earn similar yield percentages on DeFi protocols, one must overcome several steps. For example, you need to create a Metamask wallet, remember your seed phrase, buy your crypto on another exchange, deposit that crypto to Metamask, connect your Metamask wallet to a liquidity pool or DeFi protocol, and confirm you made no mistakes in the process and then start generating yield. With YouHodler’s Dual Assets, you simply need to deposit crypto to your YouHodler wallets and open a deal using our Dual Assets feature. It’s that simple and the returns are similar. It’s like DeFi but simple and fast.

4. Dual Assets is less risky than DeFi platforms

When you deposit your funds into a DeFi protocol for yield generation, you are placing an enormous amount of trust in what is often an anonymously-run organization. Yes, these protocols often promise you double or triple-digit yields but the lack of trust and security associated with these DeFi platforms is cause for concern.

5. Everyone now has access to traditional wealth management products

Dual Asset is inspired by traditional wealth management products seen in the “old world” of finance. Now, we are bringing it to crypto users everywhere so you can take advantage of yield generation strategies that were once available to a small percentage of people.

6. Clients can enjoy flexibility and risk management

Due to the short duration periods of one to three days, clients have more flexibility to invest in their crypto and manage risk more efficiently.

Dual Assets: Frequently asked questions

Dual Asset is a new product. Hence, it will come with new questions. We’ve done our best to provide answers to what we think will be the most frequently asked questions. However, if you have any more you don’t see down below, feel free to consult our Help Desk or reach out to our Customer Success Team.

Q: What is the risk of using Dual Assets?

A: Dual Assets is a win-win solution. Whether the price of your chosen assets lands above or below the linked price, you will receive your initial investment back plus some amount of yield. Therefore, the risk involved isn’t about generation loss. Instead, it’s about generating less profit than the maximum potential. For example, the higher you link a price, the more conservative your returns will be. Lower-linked price will be riskier but generate a higher return. Furthermore, the longer your duration is, the riskier your position is because there is a greater chance for something negative to happen to your position.

Q: How can YouHodler deliver such high returns?

A: In reality, the interest rates are not that large. If you divide the annual yield, the numbers are quite average. Furthermore, crypto is still very volatile daily. Between this volatility and the volume from YouHodler’s exchange operations, we can sustainably provide these rates to you while maintaining efficient liquidity. The greater the volatility we have in the market, the more volume we have on our exchange. Hence, the more yield we can offer to you. Lastly, we don’t offer floating yield rates during the deal. Rates are fixed from start to finish for additional sustainability.

Q: How are the Dual Assets rates sustainable?

A: The initial linked price determines the profit percentage. Since the initial linked price is locked in, we can offer a guaranteed*, sustainable yield based on this linked price. *Note that the profit is guaranteed but how much depends on a variety of factors like market volatility, chosen linked price, and duration of the deal.

Q: Is Dual Assets safe to use?

A: Unlike some other platforms that use client funds for external staking pools or risky leverage tactics, all client’s funds on YouHodler stay on YouHodler. We never use your funds for staking or leverage. We simply execute client orders on a deal-by-deal basis. Furthermore, your funds are never locked in Dual Assets for longer than the term length (1-5 days). After that, you are free to withdraw at any time. Lastly, all features on YouHodler are backed by our world-class security measures. Our internal security team works hard to ensure our clients have access to advanced security features like 2FA, 3FA, biometric security, and more. We also have external teams run routine audits of our platform to ensure any exposed weaknesses are immediately strengthened.

Q: When is Dual Assets available?

A: Right now! Click the button below to sign in or create your YouHodler account today.