Do you monitor crypto exchanges 24/7? We’ve been there! After all, a sudden flux in price could hurt your wallet. Whether the change is positive or negative, it’s hard to keep your eyes away from the screen for too long. A stop loss order might be your saving grace.

When used right, the correct trade order keeps your investments secure. Whether you’re an individual amateur trader or a professional broker, it’s good to know the advantages and disadvantages of this strategy. As an investor, you can always lessen risks in cryptocurrency trading.

We want to help you understand the significance of a well-placed order We have gathered significant expertise in the crypto world. We know first-hand how crucial trade orders are. Hence, check out this in-depth review explaining this strategy and its function.

Stop Loss Order explained: What is it?

A stop loss order is a specific type of conditional trade order usually used in the stock market. In the cryptocurrency trading system, this functions in a similar way.

You can compare a stop loss order to an insurance policy for your cryptocurrency. It protects a trade you’ve made, and you don’t need to check it daily. Unlike insurance though, it’s completely free.

What are conditional trade orders?

A conditional trade order operates on a set of terms. Fulfillment of the terms will activate the order. These criteria could include any kind of change in the market. There are also some criteria that you can combine. This will create a more advanced conditional trade order.Changing factors include volume, price, and time of transactions. You can base the criteria of a trade order on all these variables and more.

One kind of conditional order is a contingent order. This order occurs when two or more conditions happen at the same time. This is a useful order in case you place more than one trade or transaction at once. There are three general trade order concepts. They are stop, limit, and stop limit. These concepts can benefit a trader who wants to cover their bases on many risks at once. A stop loss order falls under the stop concept.

Suggested reading – Crypto Trading: an introduction to the Basics

How does a stop loss order work?

A stop loss order describes its purpose – to lessen (or stop) the loss you might suffer from a trade. It can either buy or sell a specific amount of crypto when there is a change in its price. The most common use of a stop-loss order is to program an automatic sale when the investment loses value. For example, let’s say that you invest $30,000 in Bitcoin (BTC). You know that the price might fluctuate, and it’s a risky investment.

You can set up a stop-loss order to occur if Bitcoin’s value decreases to $25,000 or lower. This means that once it reaches that price, a market order for your share opens. Then, the share sells for the current market price. Placing a stop loss order isn’t difficult. After you take your trading position, look at your trading pair on the platform you’re using. Under the buy and sell options, there is usually a stop loss limit option to select.

You can input the stop-loss order’s trigger price. This is the market price the cryptocurrency must reach to set the order in action. You can also set the quantity of crypto that you would want to buy or sell. It is important to note that the trigger price is not always the price your crypto will be worth once sold. Once you place it for sale, the market price might fluctuate further. If it doesn’t sell immediately, you could make more of a profit or loss than you anticipated.

What is the advantage of a stop-loss order?

Convenience

There are several pros of a stop-loss order. One is that it costs nothing to put in place, and takes very little time to set up. It’s also hands-free. You won’t have to check it all the time to make sure it’s working.

Risk Mitigation

It’s also an effective risk mitigation tool. Though it might fail in certain cases, a stop-loss order is often used because of how well it works.

Improves Judgment

It also serves to separate your emotions from the trade. Whatever your trading motivation, it can be difficult not to become emotionally invested. A stop-loss order keeps you from holding onto a possible terrible trade. It keeps you from losing focus on the main goal – making a profit.

Suggested reading: How to Manage Risks While Crypto Trading

Improves Profits

You can use a stop-loss order to buy valuable stock. It locks in unrealized gains, which are profits you will have in the future.

It does this by setting a buy order for a profitable stock that decreases the market price. You can immediately hold onto the stock until its value increases again. You can sell it once it reaches a higher value, thereby turning a profit.

What Are the Disadvantages of a Stop-Loss Order?

Short-Term Fluctuation

A momentary flux could set off a stop-loss order’s trigger price in the market. The crypto might decrease in price for a short duration. If it were to go up in price and remain stable after your crypto sells, you would have lost out on some profit.

To prevent this, you should research cryptocurrencies with the lowest downside risk possible. The downside risk is an estimation of the potential loss an investment might experience. Certain market conditions might influence a downside risk more than others. You have to analyze them closely.

Market Order Differences

Once you execute a stop-loss order, there will be a market order for your shares launched. There is the time between the market order placement and your shares being bought. During this, more fluctuations could occur. Going back to the Bitcoin example, let’s say your stop-loss order places your BTC for sale at $25,000. The market price could increase to $28,000 right after. You would still sell it for $25,000 resulting in a slight loss.

Tips for Crypto Trading: Stop Loss Examples

Let’s explore a couple of examples where traders can use a stop-loss order for their benefit.

Stop-Loss to Buy

Delilah is a successful cryptocurrency trader living in New York City. She has her eye on a trending cryptocurrency called Pretty Coin. She’s followed news about it and wants to position herself to profit. Delilah anticipates that it will rise a lot in value once it hits mainstream news sources. She thinks that once it reaches around $150 per share, many people will scramble to invest. She places a stop-loss order to buy at $140 per coin for five coins. The crypto reaches the trigger price, and Delilah purchases five coins. In three weeks, the coin rose in price to $240. If she sold them now, Delilah would make a $500 profit.

Stop-Loss to Sell

Charlie likes to trade crypto in his free time. He doesn’t have much capital to fall back on in case a trade falls in value. He uses stop-loss orders to keep his losses smaller. He made a bigger investment in Ethereum (ETH) at $1,800/ETH with ten ETH. This makes his position worth $18,000 in total. He wanted to turn at least $2000 profit. Charlie also decides to set his stop-loss order to sell at $1,400 per coin, since he can’t accept too much of a loss.

Unfortunately, the cryptocurrency experiences a security breach. Investors pull out very fast, and the value drops overnight. Charlie wakes up to find he sold his shares at $1,400, retaining most of his initial investment and avoiding significant loss. Other people didn’t think to set up a stop-loss order, believing the value would only continue to rise. They had to sell for much lower and suffered a huge loss

Can I use a stop loss order on YouHodler?

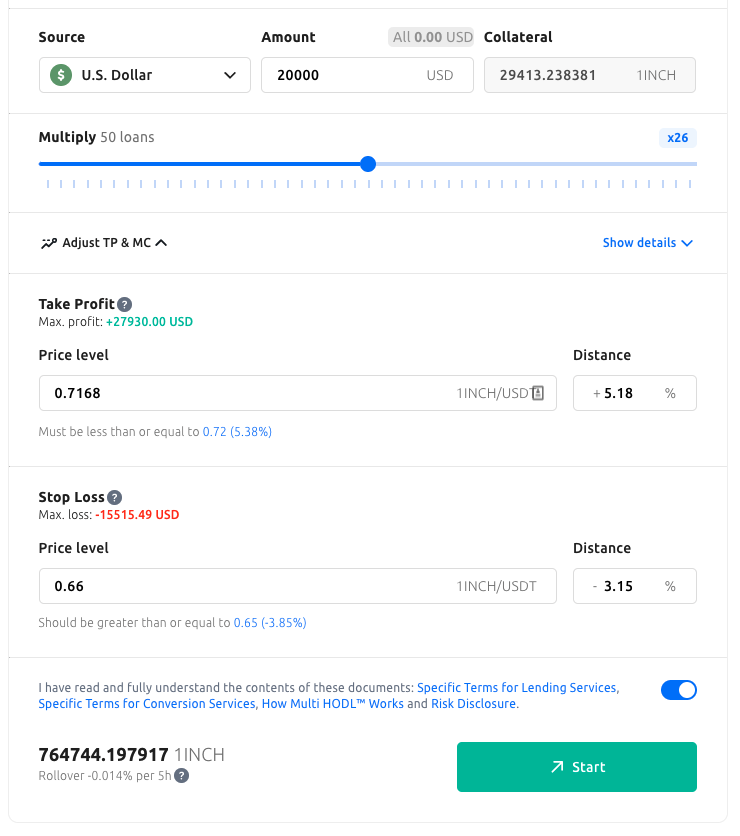

While YouHodler is different than a traditional exchange, oru advanced, automated trading solution – Multi HODL – allows traders to set stop loss orders. On our platform, we call this the Margin Call price.

If you want to long or short crypto using Multi HODL, then each deal comes with a margin call level. This is a required field. If the coin price drops below or above this level (depending on whether you are long or short) then YouHodler automatically closes the position. Hence, setting your margin call level independently ensures you exit the trade when you want to without surprises. This is very similar to using a stop loss order in traditional crypto exchanges.

Below, please see the screenshot outlining our risk management features on Multi HODL. The crypto market is volatile, but with these tools, you can mitigate risk efficiently so you spend less time worrying, and more time earning.