With every new technological development comes a new array of words. “Surfing the web” for example was a nonsensical phrase before it was coined in 1992. Even the cavemen had to come up with new terminology when they first invented fire. It’s no different today with staking crypto.

A few years ago, “staking crypto” meant nothing. Now, it’s one of the most popular aspects of the cryptocurrency industry. Staking crypto enables crypto holders to earn interest on their digital assets without selling them. That’s the basic definition. Let’s dig deeper.

Our experts have peeled back the layers of staking crypto to give you a clear definition of what it means, how it works, and how you can participate.

What does it mean to stake crypto?

In the traditional finance world, “stake” means to have “a share or interest in a business, situation, or system.” That same definition applies in the crypto world. However, the operation is quite different.

Think of staking crypto as the equivalent of putting your fiat currency in a high-yield bank savings account. When you deposit these funds, the bank takes that money and then lends it out to other loan seekers. Since you are helping them provide a service by locking your money up in the bank, you then receive payment. The payment is a portion of the interest that a bank earns from its lending.

In 1981, the global average interest rate reached its highest ever point at 16.63%. Today, you’re lucky to get anything close to 1% for locking your funds in a bank savings account. This major gap in financial services gave way to the birth of crypto staking.

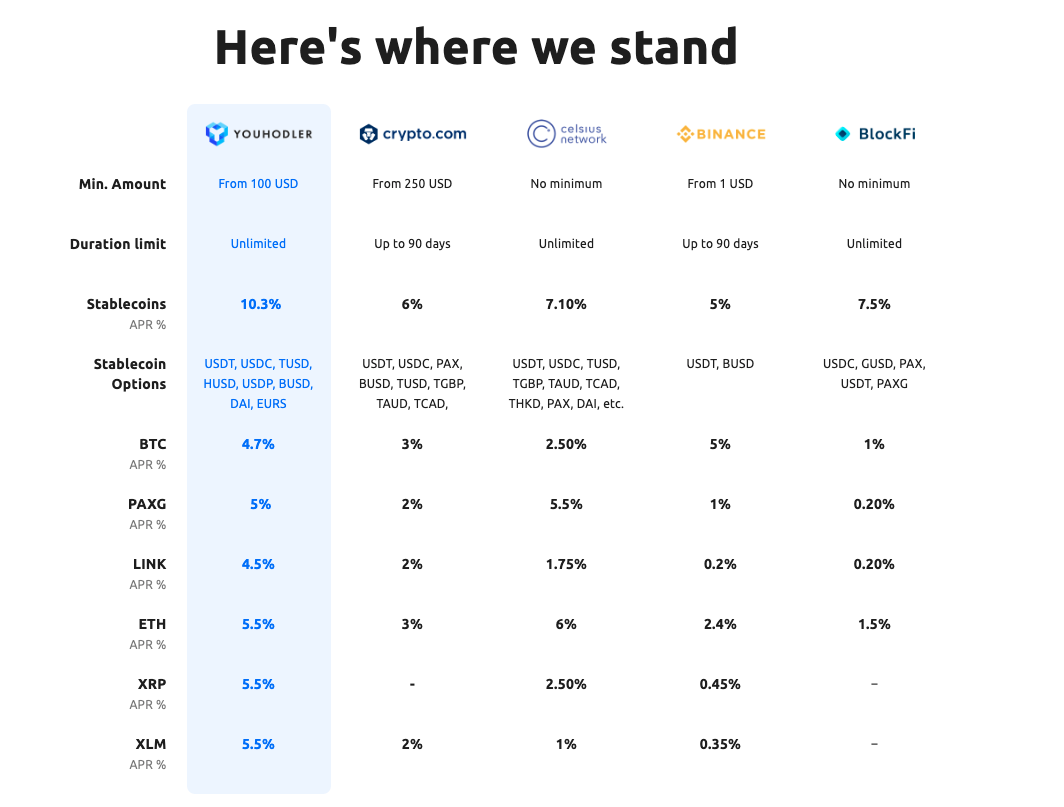

Instead of locking your funds in a bank, crypto staking involves locking your crypto in some sort of financial protocol or platform. Locking your funds in these systems means you’re helping them maintain security, operate in financial services, and maintain the blockchain. In exchange for that, you earn rewards calculated in yield percentages. The rates differ on each platform but typically, they are much higher than the low rates you see at today’s banks.

As you can imagine, staking has become a trendy way to earn a passive income in cryptocurrency. Still, it is far from mainstream adoption due to the complexities of how it works.

How does staking work?

Now we know what it means to stake crypto. We also know why it’s popular. However, how does it work from the technical point of view? While most people prefer to just “deposit and forget” while earning interest, it also helps to understand the underlying mechanism of crypto staking. This all starts with “proof-of-stake” (PoS).

Proof-of-stake

Every blockchain needs maintenance. Just like your bank ledger, a blockchain ledger needs to be organized and maintained. That way, transactions are verified correctly and the “double spending” problem is prevented. There are different methods of doing this. One such method is called PoS.

PoS is a consensus mechanism that helps verify what transactions are added to the blockchains (via a series of blocks). That’s where the proof part comes in. Proof that the transaction is valid and can be recorded. But what about the stake part?

On PoS platforms, participants called “validators” lock up their crypto in the network, thus “staking it” so they can’t use it. Validators are then rewarded with interest when they accept a new block of transactions, confirming it follows the rules of the network. If they accept a new block and define its accuracy, they “win” a block and thus, get the reward.

Since their funds are locked away, it incentivizes the validators to act honestly as their money is tied up in the network. The more funds they stake away, the larger chance they have to collect rewards and propose new blocks.

Staking pools

Staking crypto is not always about locking your coins individually in a network. A more popular method is a validator will set up a staking pool. This way, they can raise funds from a large group of token holders. This benefits the validators as they now have more funds to lock in the PoS network and earn higher rewards. Furthermore, it benefits everyday people who otherwise don’t know how to validate transactions but can still get the benefits of staking rewards. Hence, the pool participants just provide the capital while the validator does the work.

To ensure validators don’t run off with the pooled money, blockchains have their own set of rules for validators. If they break these rules, they can be locked out of the consensus process and even have their funds taken away.

How to start staking crypto?

For the beginners out there, staking crypto may seem complicated at first. Frankly, that’s because it is. However, like anything, with some practice, you will learn how to use the various decentralized finance (DeFi) protocols and CeDeFi platforms like YouHodler to stake crypto. To help you along the way, we’ve created a short, step-by-step guide on how to start staking crypto.

Buy crypto that offers staking

Not all cryptocurrency offers staking. As we talked about before, you need to use a blockchain that verifies transactions via PoS. A few popular cryptocurrencies that operate on PoS include the following:

PRO TIP: You can earn interest on ANY cryptocurrency with YouHodler wallets. PoS or PoW doesn’t matter!

Transfer your crypto to a wallet that supports staking

Now that you bought crypto, you need to transfer it to a blockchain wallet that supports staking. This could be an exchange, FinTech platform, or DeFi protocol.

Start earning interest

Every platform is different. How you will earn interest on your staked crypto differs on every platform. Hence, be sure you understand the rules and procedures first. For example, some DeFi protocols like SushiSwap may require you to join a staking pool to earn interest.

Meanwhile, other FinTech platforms like YouHodler just require you to HODL any crypto in your YouHodler wallet to generate interest. Of course, you can always spread out your funds on various platforms to get the most out of the industry’s various rates. The beauty of this new type of finance is the options. There are so many!

Staking crypto: Frequently asked questions

Before you start your staking crypto journey, please take a look at a few frequently asked questions:

Can I stake crypto on YouHodler?

While staking on YouHodler is not staking in the traditional sense, you can certainly deposit crypto to earn a yield on the platform. The major difference is your funds are never locked. You can withdraw your funds at any time. However, your funds only generate yield if they are on the YouHodler platform. Also, YouHodler never takes your funds out of the platform to use for loans or leverage. All business operations remain inside the platform.

NEW FEATURE ALERT! An exciting new yield generation feature is coming very soon to YouHodler. Stay tuned!

Which crypto is best for staking?

We do not offer financial advice. However, our research concludes that ETH, BNB, Flow, AKT, RAY, XTZ, and SOL are some of the most popular cryptocurrencies for staking. Remember, on YouHodler you can earn a yield on any available crypto or stablecoin on the platform.

Is staking crypto secure?

Nothing is ever 100% guaranteed safe. Staking crypto has some risks. There are plenty of advantages to staking crypto but there are risks as well such as price volatility and lock-up periods. Please do your research on the platform before you lock your crypto. Make sure they have a good reputation for security and client support.

How can I start staking crypto?

To start earning yield on crypto, simply download the YouHodler app for Android or iOS. Or, click the button below.