CoinShares, a crypto asset management firm, has recently reported that there has been a notable surge in weekly inflows into crypto asset investment products, reaching a record high of $2.45 billion. The cumulative inflows for the year-to-date period have now reached $5.2 billion.

According to the firm’s Head of Research, James Butterfill, the recent surge in capital inflow, along with positive price trends, has led to a notable rise in the company’s total assets under management (AuM), which now stands at $67 billion, representing the “highest level” recorded “since December 2021.”

Regional Dynamics And Crypto Asset Allocation Trends

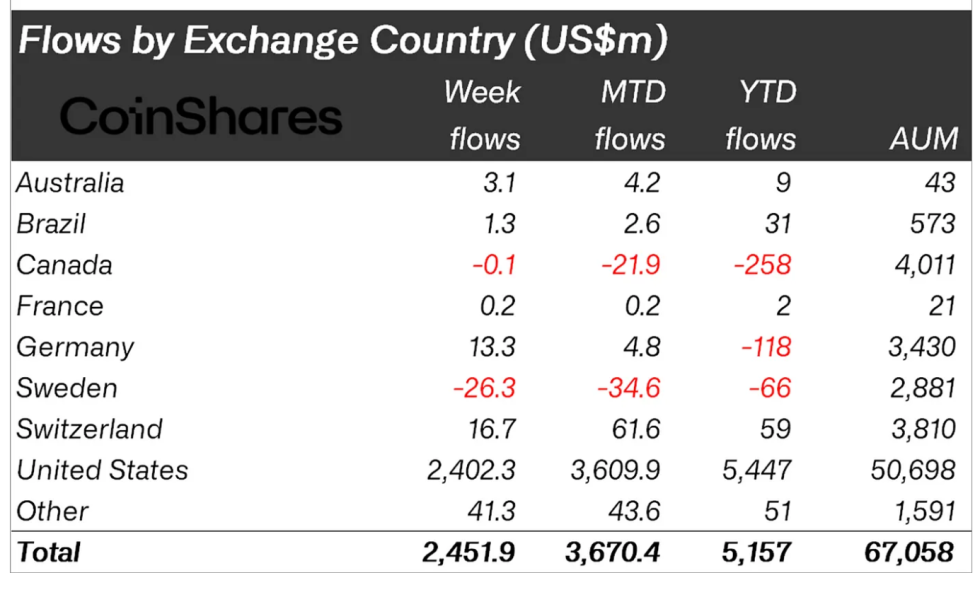

The United States emerged as the primary destination for this wave of funds, representing roughly 99% of the weekly inflows, totaling $2.4 billion. In contrast, Switzerland and Germany-based funds experienced moderate inflows, while Sweden saw significant outflows.

Butterfill disclosed that the surge in net inflows, combined with decreased outflows from established entities like Grayscale’s GBTC fund, indicates a growing interest among investors in new US spot Bitcoin ETFs.

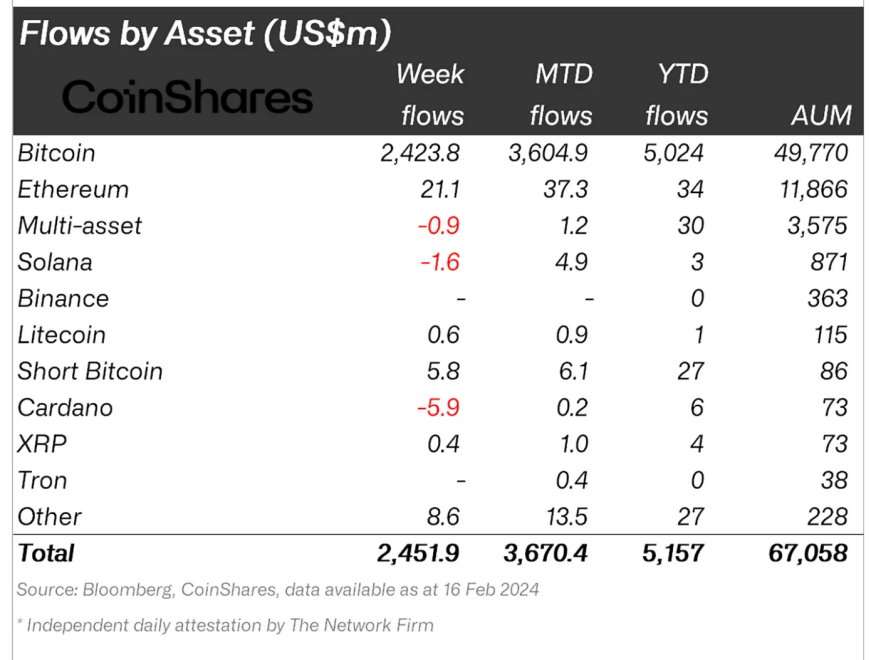

It’s worth noting that Bitcoin investment products took center stage, capturing 99% of last week’s inflows. Additionally, there was increased interest in short-bitcoin products, highlighting the diverse investment strategies prevailing in the market.

Ethereum has also experienced positive outcomes, with inflows totaling $21 million. However, as for Solana, Butterfill noted that “the recent downtime from Solana has impacted sentiment,” resulting in outflows amounting to $1.6 million.

Avalanche, Chainlink, and Polygon, on the other hand, have each seen a modest amount of inflows, making the assets “stand out” for consistently attracting weekly inflows throughout the year, as reported by Butterfill.

Expert Perspectives On Spot Bitcoin ETFs

While the introduction of the new US spot Bitcoin ETFs has generated enthusiasm within the crypto community, not everyone shares the same sentiment. Jim Bianco, President and Macro Strategist at Bianco Research, has expressed skepticism about the long-term implications of these spot ETFs.

Bianco has criticized the centralized nature of spot Bitcoin ETFs, labeling them as an “ambition of failure” that could undermine the decentralized principles of Bitcoin. The Macro Strategist argues that relying on these spot ETFs risks entangles Bitcoin in the centralized financial system, contrary to its core ethos of decentralization and immutability.

Bianco’s remarks underscore the debate surrounding the integration of traditional financial instruments with emerging digital assets. Despite differing opinions, Bitcoin’s upward trajectory continues, with the cryptocurrency witnessing a 6.8% increase in the past week alone.

Trading above $52,000 at the time of writing, Bitcoin’s resilience is also reflected in its daily trading volume, which has stood above $20 billion over the past 7 days.

Featured image from Unsplash, Chart from TradingView