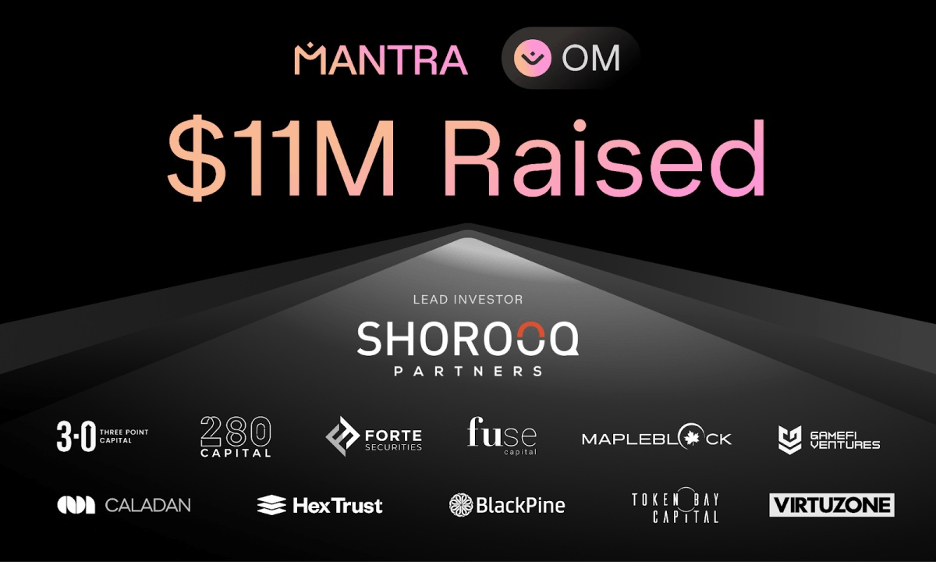

Real world asset-focused blockchain MANTRA is ready to advance its mission of increasing financial accessibility after closing on an $11 million funding round today. The round was led by Shorooq Partners, one of the top technology venture capital firms in the Middle East and North Africa region, and saw participation from Three Point Capital, Forte Securities, Virtuzone, Hex Trust, GameFi Ventures and others.

MANTRA’s main goal is to help make RWAs go mainstream, creating the infrastructure that will make it possible for billions of dollars’ worth of assets and capital to live on-chain. Its novel MANTRA Chain platform provides developers with a fully compliant-by-design blockchain they can use to host and trade RWAs. Through this, it’s aiming to entice traditional financial firms to explore the opportunities presented by blockchain and capitalize on the rising interest in digital assets.

RWAs are tokenized representations of physical assets, and can encompass almost anything, including traditional stocks and shares, commodities, foreign exchange, real estate, debts and invoices, and even more exotic investments such as fine art, aged bottles of wine and the rights to revenue from influencers and so on. Almost anything can be tokenized, with the main advantage being that it’s much easier to buy and sell without any paperwork or intermediaries.

In many markets, tokenization will make assets more accessible. For instance in real estate, it’s possible to tokenize a property and represent it as, say, 10,000 NFTs. Each NFT holder would own a 1/10,000th of that property. This makes real estate more accessible, and the ability to trade those tokens on a decentralized marketplace also improves liquidity in the market.

Expanding MENA Markets

Tokenized assets have enormous potential to improve almost every financial market, and so MANTRA has a big opportunity within its grasp. To that end, it’s aiming to build the infrastructure to support RWAs at scale. The money from today’s round will be used to achieve three very specific objectives, it said, including building out its regulatory-compliant blockchain platform in-line with global standards. Its second objective is to create the toolset for developers to create RWAs on the MANTRA Chain easily, while its third objective is to identify and capitalize on specific opportunities for RWAs in the MENA region.

Ultimately, MANTRA wants to make investing in financial markets more accessible in MENA in order to stimulate economic growth in the region. It says MENA markets have higher barriers to entry than those in Western countries, and it believes RWAs will go some way towards overcoming them. This will attract more global investors and hopefully increase prosperity in the region.

It’s this level of ambition that proved so attractive to Shane Shin, founding partner of Shorooq Partners. He said the company stood out for its pioneering approach to RWA tokenization, in particular its commitment to regulatory compliance. “Their strategic focus on significant markets like Hong Kong and Dubai aligns with our vision for financial innovation and inclusion,” Shin added. “We’re investing not just in technology, but in a future where digital and traditional assets converge seamlessly.”

Protocol-Level Compliance

MANTRA offers a novel approach to compliance, aiming to integrate this at the protocol level, so that every kind of RWA launched on its platform will automatically adhere to global regulatory standards. For instance, transaction monitoring will be implemented as a protocol-level primitive, meaning that every trade on its platform complies with global Anti-Money Laundering or AML standards. It plans to launch the world’s first fully-compliant decentralized exchange platform later this year as a showcase of its technology. Developers who create dApps on MANTRA Chain will also be able to take advantage of the blockchain’s compliant nature.

In essence, it wants to be the first blockchain to automate compliance for Web3 developers.

One of the ways it ensures users play by the rules is its use of decentralized identities, known as DIDs. With this, users must first verify their identities with a third-party KYC service provider. Once they do this, they’ll be issued with a Soulbound NFT that serves as their on-chain identity. They will then be able to access any dApp or service built on MANTRA Chain without having to reveal their identity or undergo KYC again.

Alongside the funding, MANTRA announced the launch of its incentivized testnet, called Hongbai, which is a portmanteau of “Hong Kong” and “Dubai”. With Hongbai’s launch, MANTRA is finally able to begin onboarding users in those regions and start building bridges between their traditional financial markets and Web3.

MANTRA CEO John Patrick Mullin said today’s round solidifies the company’s commitment to Hong Kong and the Middle East and accelerates its vision of bringing their financial ecosystems on-chain. “We’re crafting an infrastructure designed for builders, institutions, enterprises, and users keen on exploring RWAs,” he said. “It’s a testament to our mission of making asset tokenization a cornerstone of financial inclusivity and market development.”