In the middle of an outstanding bull market for the whole crypto space, Ethereum stands out in a big way. And it’s easy to see why. On one hand, we have the rise of DeFi and the NFT craze. On the technical side, we have the EIP-1559 update coming in July. And on the corporate side, Visa settling transactions in USDC, the EIB’s €100M digital bond, and the release of CME Ethereum Futures.

Besides that, ETH’s price kept going up while BTC stumbled. That is unprecedented. It was a crypto rule that Altcoins followed Bitcoin wherever it went. Bitcoinist reported the phenomenon as it happened:

Mira Christanto, a researcher at Messari, registered a negative correlation between Bitcoin and Ethereum in the daily chart. With a -4% and a +7%, respectively, Christanto highlighted that this is an unusual event and could be “indicating a start of a new phase”.

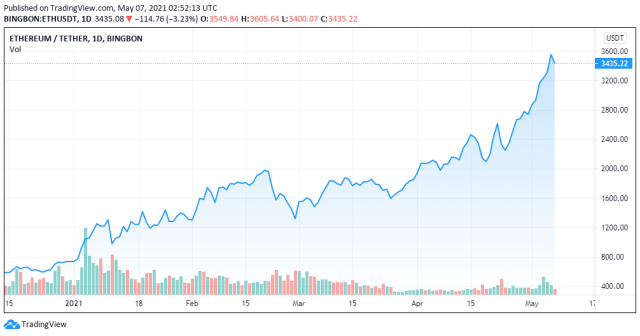

ETH price chart on Bingbon | Source: ETH/USDT on TradingView.com

Action in the Ethereum ecosystem

Bitcoinist also reported that de two biggest players in de DeFi space recently surpassed the $1B in Total Value Locked. And Ethereum is supposed to surpass the $1B in TVL by itself in the near future. Even though that’s a drop of water to the sea that is the global financial system, it’s important to remember that the whole DeFi space has only existed for a couple of years.

Related Reading | Eerie Nasdaq Fractal Predicts Bitcoin Is About to See Its Next Leg Higher

On the other hand, when the EIP-1559 update is in place, the Ethereum Virtual Machine will burn a portion of each transaction’s fees. That will make ETH a disinflationary asset. Miners are already rallying against the update, which they feel will rob them of a piece of their earnings. The real question, though, is how will that affect the price? Only time will tell.

You know you are involved in a MAJOR bull market when you repeatedly catch yourself saying:

“I sold some way too early”

or

“I could have been a millionaire if only ____(fill in the blank)_____________________ $ETH pic.twitter.com/9P5fxx1XWc— Peter Brandt (@PeterLBrandt) May 6, 2021

Institutional Acceptance

One of the crypto space’s big stories from the last few months is how global finance embraced Bitcoin. Nevertheless, making less noise, Ethereum also gained ground in institutional acceptance. The credit card giant Visa will not only accept USDC for settling transactions, the company will also run its own Ethereum nodes.

Just last week, the European Investment Bank announced the creation of a two-year Ethereum digital bond. In a timely manner, Bitcoinist reported:

Citing undisclosed sources familiar with the matter, notes will be registered on the Ethereum blockchain using smart contracts, and the sale itself will be managed by banking giants like Goldman Sachs, Banco Santander SA, and Societe Generale. The tokenized bonds could then theoretically be issued to buyers via an Ethereum wallet.

Related Reading | Is SafeMoon Really… Safe? What Is It And Why It’s The Talk Of Crypto

That’s a huge sign of acceptance by respected global financial institutions. Back in February, we received another sign. The Chicago Mercantile Exchange or CME released ETH futures in their platform geared towards financial institutions and big players. Some analysts think that this is the moment that Ethereum’s unprecedented bull-run started.

The product keeps gaining ground against the CME Bitcoin futures, as Bitcoinist reported:

During the first seven days of trading, ETH futures volume on CME was only $23 million. Recent data shows one-week volumes are now totaling $353 million – a new all-time high record that keeps getting broken again and again.

Figures provided by CryptoCompare, reveal that CME ETH futures represented 1.36% of their BTC equivalent to start, but since spiked as high as 9.36%.

In conclusion, we’re in the middle of “a MAJOR bull market,” as Peter Brandt said. And it’s Ethereum’s time to shine.

Featured Image by Adeolu Eletu on Unsplash - Charts by TradingView