Bitcoin has the spotlight this month, too.

After a small setback, the world’s biggest cryptocurrency is back in action. As of the time of writing, BTC has recorded a 4.18% jump on the daily chart and is about to reverse the losses on the weekly chart.

The long-anticipated $50K is on the horizon.

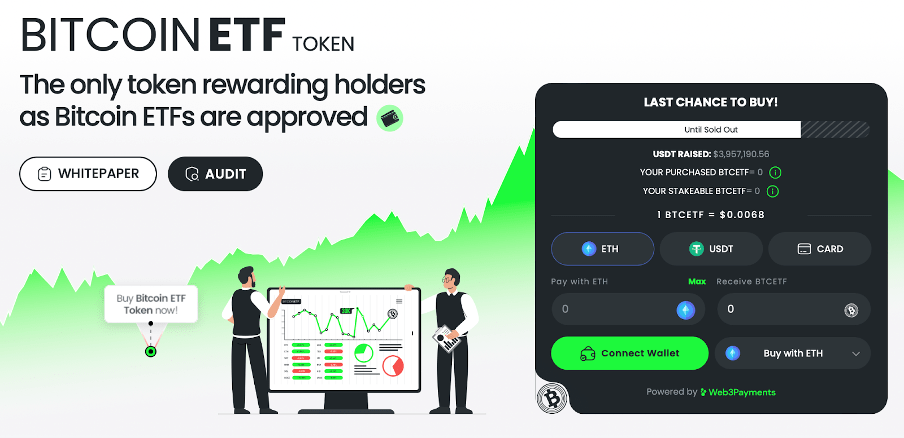

But a new cryptocurrency continues to steal attention away from Bitcoin. With a cleverly straightforward strategy, Bitcoin ETF Token or $BTCETF has been trending in the market for the last few days. Strategic investors are eagerly buying into the $BTCETF presale, in the hope of riding the next bull wave.

Get ready for the imminent transformation in the #Crypto and #StockMarket realms as #Bitcoin ETFs aim to enhance accessibility to digital assets for every trader. 🌐💱

Supported by key figures such as @BlackRock, the outlook for #BitcoinETF appears very bright! #Web3 pic.twitter.com/7fwsK8leIU

— BTCETF_Token (@BTCETF_Token) December 13, 2023

A Long List of Bitcoin ETFs Awaits Approval

The ongoing bull wave in the crypto market owes a lot to the excitement around the potential ETF approvals. Bitcoin halving, due next year, is another factor driving the price of the token.

Bitcoin ETFs allow traditional investors to invest in Bitcoin without exposing themselves to the risks that come with direct ownership. This includes setting up and managing crypto wallets and trading the assets on crypto exchanges. ETFs, being regulated, provide a straightforward way to dip their toes in the crypto market.

With the approval of Bitcoin ETFs, investing in the crypto market will become more accessible and convenient for traditional investors. In addition to that, it allows for better diversification, liquidity, and professional management. It will widen the investor base of Bitcoin, paving the way for mainstream and brand adoption. This, in turn, can stabilize the price action of Bitcoin and the broader crypto market to a great extent.

A long line of companies have applied for Bitcoin ETF applications, with deadlines falling in January 2024. If the SEC approves these assets, it will mark the beginning of a new era for the crypto market.

Meme, or is There More to it?

It goes without saying that the long-awaited crypto bull market has to do a lot with the potential approval of BTC spot ETFs. It is the primary driving force behind the upward trend that began a few weeks back.

With its simple and on-point name, Bitcoin ETF Token capitalizes on the trend. It gives users better exposure to the recent developments in the Bitcoin market than Bitcoin itself. Investors are diversifying their portfolios to accommodate Bitcoin ETF Token, as a result.

But that doesn’t completely explain the growing traffic to the ongoing presale of $BTCETF tokens. The investment appeal of $BTCETF lies beyond its title that cashes in on the market events.

Being a low-cap gem, $BTCETF also has a larger room for growth than Bitcoin. The token has yet to go live on public crypto exchanges. It is now selling for discounted prices at the presale, which stands out as an appealing feature for investors.

VISIT BITCOIN ETF TOKEN WEBSITE

This presents a larger growth scope for the project, translating to a potentially higher return on investment. The substantial traffic to the $BTCETF presale reflects the growing enthusiasm for its vision.

The token aims to distance itself from hollow pumps often associated with meme coins. It secures its longevity and relevance in the market by implementing a reward system closely tied to Bitcoin’s journey.

Rather than just riding the wave of excitement kindled by Bitcoin, it aligns its roadmap with Bitcoin’s future trajectory. Bitcoin ETF Token’s low cap thus allows investors to get exposure to Bitcoin sentiments, not just in the present, but also over time.

#BitcoinETF enacts a 5% burn tax per transaction, leading to a gradual reduction in the #Token supply.

Intending to burn 25% of tokens upon reaching milestones.

This deflationary tactic aims to benefit holders and alleviate selling pressure. 🔄 pic.twitter.com/TJE8KNogd9

— BTCETF_Token (@BTCETF_Token) December 14, 2023

Stake-to-Earn, Burning, and Tax

DeFi mechanisms integrated into Bitcoin ETF Token’s roadmap play a crucial role in its sustainable price action. With stake-to-earn, burning, and tax systems, $BTCETF puts forward a unique blend of hype and practical utility.

- The stake-to-earn system encourages holding by allocating a substantial 25% of the total token supply for staking rewards. It stimulates early investment and fosters community engagement. The APY (Annual Percentage Yield) decreases as new investors join the ecosystem, giving early backers a distinct advantage.

- The burning mechanism eliminates 25% of the token supply permanently over time. It also incentivizes holding by bringing controlled scarcity into the picture.

- The sell tax structure reduces the risk of abrupt token dumps by discouraging initial selling. The tax begins at 5% and gradually decreases by 1% as the project achieves new presale milestones. All proceeds from the sell tax go to a burning protocol.

The DeFi solution underscores the project’s long-term investment potential.

Analysts Predict 10X Surge

According to analysts like Jacob Bury, known for his low-cap finds, $BTCETF can feature a significant 10X surge after its presale.

The project’s strategic alignment with Bitcoin ETFs and their associated price movements gives it a competitive edge in the market. New milestones in the Bitcoin market will influence the token’s price action upward. The diverse DeFi mechanisms, on the other hand, will be pivotal in sustaining its price dynamics amid market downturns.

VISIT BITCOIN ETF TOKEN PRESALE