After reaching over $38,000 for the first time in 2023 this Friday, Bitcoin has stabilized in a tight trading range according to top crypto analysts and is trading around $37,800 at the time of writing.

While struggling to break above this key resistance level, signals highlighted by CrediBULL Crypto point to growing institutional interest keeping a floor under prices.

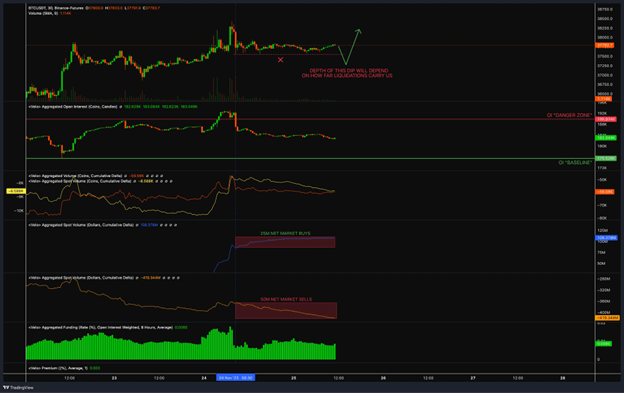

In his recent X (Twitter) post to over 355,000 followers, top analyst CrediBULL noted that “BTC is looking really good here” as he examined recent developments since his previous analysis. As CrediBULL pointed out, “aggregate OI continues to fall within this tight range, indicating we are getting some de-leveraging here which means liq cascades in either direction may not be as significant. This is healthy.”

The analyst went on to say Coinbase has not begun selling off its spot holdings and has instead “been consistently buying since my last post.” CrediBULL also noted that despite takers net selling within the range thanks to Binance spot sellers, “price has remained flat- indicating we likely have limit buyers absorbing a significant portion of these market sells. This is also healthy.”

CrediBULL observed funding and prep premium have been relatively flat as well. He concluded that “dips here may be even more shallow than originally anticipated due to the lack of OI to induce liq flushes and the clear spot demand we are seeing at these levels.” While CrediBULL had previously looked for a dip to $36,900, he acknowledged that level now seems out of reach “it seems like even that may be out of reach at the moment.”

Another top analyst, Crypto Caesar, told his followers he expects Bitcoin to break above $42,000 resistance and rally to the $48,000-$50,000 range initially. From there, a standard deep pullback would follow to find support according to long-term technical patterns. Caesar notes Bitcoin usually corrects significantly after reaching new highs, however the current sideways trading represents a healthy consolidation (aligned with Fibonacci 0.786 level)

Overall, multiple analysts highlight positive signs of stable spot buying offsetting selling pressure within this tight range. Technical signals point to dips being shallow ahead of an eventual breakout above resistance. Of course, geopolitical or macroeconomic shocks remain outlier risks that could shake short-term sentiment.

How BTCETF is Positioning Itself for Potential Gains from Bitcoin ETF Approval

For crypto investors seeking to potentially profit from the launch of a U.S. Bitcoin ETF, what opportunities exist? One innovative and emerging token to consider is BTCETF. As its name implies, BTCETF aims to capitalize on the approval and rollout of the first Bitcoin ETF products greenlit by the Securities and Exchange Commission (SEC).

BTCETF is currently conducting an ongoing presale to fund its initiatives and operations. The presale has already raised over $1.7 million from investors attracted to the project’s innovative model. BTCETF tokens were priced at $0.005 during the presale but have risen 25% to a price of $0.0058 based on strong demand.

Project leaders have indicated the token price will increase again to $0.006 within just one day as the presale continues. This tiered pricing structure provides incentives for early participants. Once the presale concludes, BTCETF aims to list its tokens on major centralized and decentralized exchanges immediately to facilitate broader trading.

To position itself for the expected inflows, BTCETF employs a deflationary supply model which already appears to be generating significant hype. The project plans to burn a total of 25% of its initial token supply through a series of milestone events tied to ETF approval progress. For example, 5% will be destroyed once the SEC finally allows a Bitcoin ETF. Another 5% burn occurs at launch of the first physically-backed product.

Further burns are scheduled for when total assets under management in ETFs surpass $1 billion, and if Bitcoin reaches a price of $100,000. By closely aligning major token reduction events, BTCETF provides direct exposure for investors anticipating an SEC change of stance. It also rewards holders through a diminishing available supply.

BTCETF has garnered significant hype due to its close alignment with the developing Bitcoin ETF narrative in the United States. Investors are optimistic about the project’s deflationary token burning model and the potential returns it could provide. If the first SEC-approved Bitcoin ETF launches as BTCETF expects, and its other milestones linked to ETF approval timelines are met, the token’s supply reductions could translate to triple-digit price gains for early holders.

By establishing clear links to this impending regulatory evolution, BTCETF has successfully tapped into the anticipatory sentiment building around a potential breakthrough on the U.S. ETF front.

For the full details on BTCETF’s milestones, tokenomics and the evolving outlook on ETF approvals, check their website and documentation. As the SEC decision deadline for pending Bitcoin ETF applications draws near, this innovative altcoin offers traders a speculative way to profit from expectations of regulatory change. Overall, multiple positive factors point to Bitcoin’s resilience around $38,000 as the narrative shifts towards broader acceptance in traditional finance.

Both Bitcoin and the BTCETF token seem well positioned based on technical signals and trends in their respective markets. Top analysts note institutional interest stabilizing Bitcoin after its latest rally attempt faded short of breaking key resistance. Meanwhile, BTCETF capitalizes on growing anticipation for a potential Bitcoin ETF green light through an ambitious deflationary model. Continued stable accumulation around these levels could set the stage for breakthrough price moves in the months ahead that benefit both Bitcoin itself and related investment vehicles. The coming regulatory and adoption milestones will prove decisive for the entire crypto sector.