In traditional markets, experienced stock traders use a method called fundamental analysis to determine which assets are worth investing in. The fundamental analysis differs from technical analysis in that traders take a step back away from the trading charts and trend lines. Instead, they look at the overall fundamental aspects of the company such as management, technology, the economy, and more. This same strategy can be applied in the crypto market as well. We managed to dissect the best parts of fundamental analysis so we can break it down and translate it into crypto terminology for you.

What is fundamental analysis and its objectives?

While traders use technical analysis to zoom in on the performance of an asset – often down to the minute on trading charts – fundamental analysis is the opposite. Instead, traders zoom out. This allows them to get an overarching view of the asset and the company that supports it.

Surely you’ve heard the famous quote “invest in people, not products.” Essentially, this quote summarizes the entire concept behind the fundamental analysis. Traders that believe in fundamental analysis say that the company’s strength behind the asset is the primary factor of its future success. This is a great strategy for those looking to buy undervalued assets.

“Invest in people, not products.” — Investor proverb

For example, let’s say a new tech stock has a low market capitalization and the stock’s trading chart is not impressive. However, after some research via fundamental analysis, you determine the team is very talented, has a clear roadmap, and has strong characteristics all around. Hence, you just determined the asset is undervalued meaning it’s an excellent opportunity to buy in.

Meanwhile, a project may have a very high market capitalization yet exhibits weak fundamentals. That means this project will not likely stay on top long and it’s a good time to exit. Analysts refer to this as the “intrinsic value” of an asset – meaning its true value (hypothetically). Unfortunately, there is no clear-cut formula to determine intrinsic value. But fundamental analysis certainly can help.

So as you can see, fundamental analysis is a good strategy to use in tandem with other asset analytics. Now that you know the objectives of this strategy, let’s learn how to do it.

Five ways to help you analyze asset fundamentals

There is no set rule book on how to conduct fundamental analysis. We encourage you to get creative with it! However, to get you started, here are five techniques that can help you during your asset research process.

1. Read the whitepaper or information memorandum

Most companies – startups and established organizations – often have a whitepaper or information memorandum. This document contains all the information about the team, their history, the company’s future goals, and more. When reading one of these documents, don’t just look for information. Analyze the finer details as well.

Does the document contain many spelling or grammatical errors? Does it seem poorly designed or in general, has a shady feeling to it? If so, then you probably don’t want to invest in that company. If all the small details look good, then you can get to the meat of the content.

Reading a whitepaper or information memorandum helps you answer the important questions about the project. For example, what is the problem this team wants to solve and how will they do it? What are the plans for the project? What is the background of the team members? Are there any investors? If so, what is their stake in the company and how much influence do they have? Ultimately, the answers to all these questions will affect your investment. Therefore, you need to find out before putting your money down.

2. Research the target market and competitors

Understanding the role of a project in a given market is an important part of fundamental analysis. Any good project should be trying to solve a problem in the world and that problem has a target market. Is the target market a bunch of gambling addicts looking to get rich quickly? If so, that’s not a wise investment.

However, let’s say the target market is men and women aged 30 – 55 that care about the environment and want to support renewable energy. That seems like a much more stable and healthy target market with longevity. Your money is safer with that project than the one promoting get-rich-quick schemes.

After you understand the target market and the role a certain asset plays, you then must check out its competitors. Which project has more advantages over the other? Take a look at the different communities, teams, and road maps of the competing companies to see which one you think has the greatest chance for success.

3. Do a deep dive on the team members

Most of the time, a project publicly lists its team. This is less common in the Decentralized Finance (DeFi) world. That’s one reason it’s a risky niche. However, the large majority of crypto projects and traditional companies have public information about their team. Before investing, you must take the time to research each team member in the project. Look at their resume, education background, public profiles, and more. If you think the team comes from a well-educated and successful background, then the odds of them producing a good project are higher.

4. Understand the corporate governance structure

Corporate governance is the rules and policies that take place within an organization. Specifically, this determines the responsibilities between management, directors, and then shareholders/stakeholders. The corporate governance structure should be very clear, efficient, and transparent. If not, then we recommend staying away from them. Remember, if something about a company is not clear, it’s probably that way because the company doesn’t want you to understand it.

5. The business model

What does the company do? This should be covered clearly in the white paper or information memorandum, However, it’s also possible the company doesn’t have either. Hence, it’s up to you to determine the company’s business model. This isn’t always as easy as it seems. Take McDonald’s for example. You may think their business model is selling hamburgers around the world. While that’s true, they make the majority of their money via real estate. So think twice before assuming a company’s business model.

Crypto fundamental analysis: How do you analyze crypto projects

Can you apply the same rules listed above for crypto fundamental analysis? Absolutely! Of course, there are a few differences and even additional factors to consider. For example, understanding the token economy of a crypto project is something new that one wouldn’t do in the stock market. However, it is similar to analyzing the shareholder’s influence and profile.

Token economy, or tokenomics, describes how the distribution of tokens occurs within the company and how it’s circulated into the market. Ideally, you want to look for projects that have a more balanced tokenomic profile. If the private investors hold 90% of the tokens for example while 10% are just for the public, then that means the private investors hold too much power over the price of the token and are a high-risk investment.

Other red flags to consider during crypto fundamental analysis are inactive social media accounts, fake followers or bots, no auditing process or security checks, and little information about the founders.

How to use the blockchain in your crypto fundamental analysis

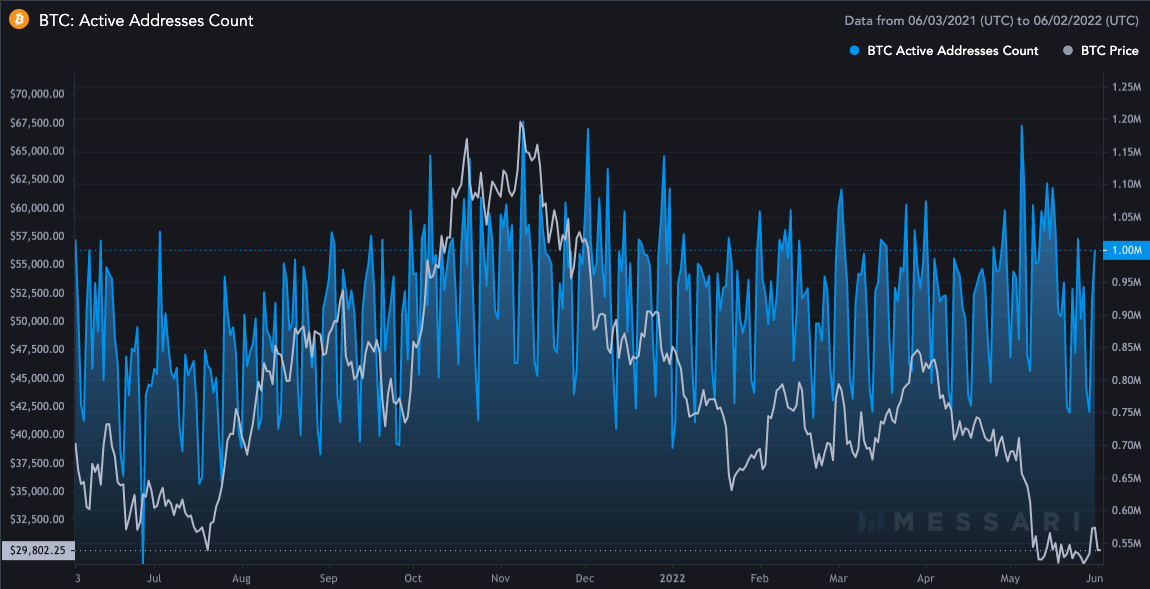

Compared to the stock market, crypto fundamental analysis has a unique advantage due to blockchain technology. Thanks to its public and transparent data, anyone can see on-chain data for various assets. This helps you with crypto fundamental analysis as well.

For example, on-chain data such as the number of transactions and number of active addresses give you a behind-the-scenes glance at an asset’s popularity and intrinsic value. Some assets may not be high in price but show high levels of activity. That’s usually a good sign and a good opportunity to buy crypto while it’s undervalued.

Fundamental analysis vs technical analysis

Warren Buffet famously promotes fundamental analysis as his go-to research method. That’s certainly in line with his brand of long-term, value investing. It’s a safe strategy that looks behind the scenes of a company’s operation to ensure the investment will be profitable. Technical analysis on the other hand is better suited for short-term traders who do not care so much about long-term valuation. Instead, they base their technical analysis on market psychology to determine short-term trends and identify price signals for entry and exit. Neither technique is right or wrong. Ultimately, it decides which style of investing you want to go for.

Does fundamental analysis guarantee you profit?

As many of you know by now, nothing is guaranteed in the stock market or the crypto market. You can be the best fundamental analyst in the world and still fail on an investment. Just because your research shows a stock or crypto asset is undervalued, that doesn’t mean it will rise in value soon. Life isn’t that simple and there are always a variety of factors that can surprise you and influence price (e.g. “black swan” events).

If you want the best chance of success, it’s best to use a strategy that uses a combination of safe stable assets and other techniques that are slightly riskier but more profitable (e.g. the Barbell Strategy). Furthermore, it’s good to combine fundamental and technical analysis to get the most well-rounded view of an asset in the short and long term.