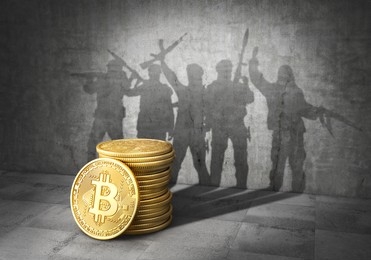

The United States Department of the Treasury’s Office of Foreign Assets Control (OFAC) has announced a new round of sanctions targeting networks and facilitators involved in crypto transactions linked to the terrorist group Hamas.

The move comes in response to Hamas’ alleged continued efforts to exploit various financial transfer mechanisms, including cryptocurrencies, to fund their terrorist activities.

Sanctions On Crypto Networks Linked To Hamas

Under Secretary of the Treasury for Terrorism and Financial Intelligence, Brian E. Nelson emphasized that Hamas has been using crypto assets and other means to channel funds to support its illicit operations.

The US Treasury, in collaboration with its allies and partners, is committed to leveraging its authorities to target Hamas, its financiers, and its international financial infrastructure, Nelson said in the announcement.

The latest sanctions focus on Hamas-affiliated financial exchanges in Gaza, their owners, associates, and financial facilitators who have played significant roles in transferring funds, including through cryptocurrency, from the Islamic Revolutionary Guard Corps-Qods Force (IRGC-QF) to Hamas and Palestinian Islamic Jihad (PIJ) in Gaza.

The United Kingdom and Australia have also concurrently imposed sanctions on key Hamas officials and facilitators.

According to the regulatory authority’s statement, these recent actions build upon previous joint designations by OFAC and the United Kingdom, targeting Hamas leaders and financiers.

The United States has also taken independent actions to disrupt Hamas support networks and financing, including designations in October, November, and December of the previous year, as well as in May 2022, targeting officials and companies managing Hamas’s secret international investment portfolio.

Crypto companies, including Tether, have taken swift action to combat these illegal activities. Tether announced the freezing of 32 crypto wallet addresses. These addresses hold a total of $873,118 and are believed to be linked to activities related to “terrorism and warfare” in Ukraine and Israel.

Tether CEO Paolo Ardoino emphasized that blockchain platforms make it easy to track cryptocurrency transactions, which allows Tether to help prevent the use of the company’s stablecoin USDT associated with funding terrorism.

Financial Crackdown

According to the OFAC’s investigations, the Shamlakh Network, consisting of individuals from the Shamlakh family, has emerged as a crucial channel for funds transferred from the IRGC-QF to Hamas and PIJ in Gaza. Zuhair Shamlakh, a Gaza-based “moneychanger,” has facilitated transfers amounting to tens of millions of dollars from Iran to Hamas.

Shamlakh’s companies, Al-Markaziya Li-Siarafa (Al-Markaziya) and Arab China Trading Company, have allegedly played “instrumental roles” in channeling funds for Hamas’s military wing, the Izz al-Din al Qassam Brigades (al-Qassam Brigades).

Other members of the Shamlakh family, including Ahmed, Alaa, and Imad, have also been involved in the financial flow from Iran to Hamas and PIJ, utilizing ties to money-changing companies such as Al-Markaziya.

The Herzallah Network, on the other hand, has been implicated in illicitly transferring crypto funds from Gaza to the West Bank to finance recruitment and weapons purchases by Hamas.

The Gaza-based Herzallah Exchange and General Trading Company LLC, owned by Muhammad Fallah Kamil Hirzallah and others, have collaborated with Hamas in facilitating transactions, including using cryptocurrencies.

As a result of these sanctions, all property and interests in property of the designated individuals and entities within US jurisdiction or under the control of US persons are blocked and must be reported to OFAC.

Lastly, non-US financial institutions and other entities engaging in certain transactions or activities with the sanctioned individuals and entities may also expose themselves to sanctions risk or enforcement actions.

Featured image from Shutterstock, chart from TradingView.com