Price movements in a market drive trades. Without them, trading and investing to make a profit is not possible. When these movements become too fast and unpredictable, though, they’re defined as volatile. Volatile trading can sound scary, but there are several ways to take advantage of these speedy price movements.

High volatility can create opportunities for traders – especially those who use short-term strategies. Armed with the right knowledge and technique, you can maximize the potential of volatile trading. We created an in-depth guide explaining exactly how to use volatility to go beyond your trading goals.

What is volatility?

Volatility is the speed and significance of price movements. When both are high, the market is volatile. This means the direction in which the price moves is irrelevant. When there’s volatility, the price is fluctuating downwards, upwards, or both rapidly.

Volatility creates uncertainty and makes trading more complicated. It can last anywhere from a few days to months, to even years! Volatility usually affects a general market, but only a specific asset or group of securities can experience it. Including cryptocurrencies.

A volatile market or security creates opportunities to turn more profit than normal. To best do this, you have to first understand why it’s occurring.

What causes volatility in cryptocurrency?

Several factors cause volatility in cryptocurrency. Some examples are:

1. Employment rates

While not a direct cause, employment rates can affect inflation volatility. This causes volatility in the financial market, as it reduces the purchasing power of a country overall. Research shows that countries with better employment regulations suffer from less inflation as a result. These employment factors include coordinated wage systems and strong unions for workers.

2. Inflation and prices of commodities

Inflation causes prices and interest rates to go up – and hyperinflation can make them skyrocket. Both of these factors drastically impact the financial market. When prices for commodities go up, people have less capital to invest and trade.

Traders could liquidate their assets, causing a crash. On the other hand, people might also turn to cryptocurrency to hold their value. This could majorly increase its prices and draw attention from traders elsewhere in the world.

Suggested Reading: Cryptocurrency and Inflation: Is There a Connection?

3. Economic recession or growth

Economic recession makes it difficult for companies to maintain their profitability, causing a massive decline in the stock market. During a recession, stocks usually fall and then rise suddenly.

Economic growth can cause significant increases in value. A security that is growing quickly will attract more traders, boosting its liquidity. Likewise, it can affect even cryptocurrencies. Though crypto blockchains are decentralized, some crypto coins are pegged to fiat currencies. Their value can affect their exchange rate.

4. Quarterly results

Established cryptocurrencies publish their earnings publicly every quarter. Volatility is spurred before and during this time and becomes worse just after the quarterly results. Traders will try to prepare, predict, and protect their crypto before the results are published.

Afterward, they will use the new information to enter into new crypto investments or exchanges or change their current strategy. The quarterly earnings are a solid basis for planning out improved financial choices based on past trends. With so much movement at once, traders can expect volatility.

5. A change in management

In the stock market, a new CEO or board of directors can impact a company’s shares. In cryptocurrency, the same could be said for the founders of a cryptocurrency. While traditional management roles don’t apply to a decentralized blockchain, cryptocurrencies do have founders and developers.

Blockchain developers develop and execute a blockchain, using their coding knowledge to build a unique digital currency. During the crypto’s first launch, a change in the developer team could cause new crypto features, impacting investments and leading to volatility.

6. New launch

A new launch of features or tangential products of a cryptocurrency can also cause volatility. For example, the Ethereum Merge in 2022 sent some crypto prices on a ride.

How to use volatile trading to your advantage

Sure, volatility is highly risky but with the right knowledge, you can use volatile trading to your advantage. Here are a few pointers on how to do so.

Define goals and risk measures

Before doing any trading, you need to ensure you are comfortable with volatile trading. Defining concrete goals and setting measures to decrease risk are necessary to keep your securities safe. However, they’re also needed to keep you, the trader, impartial in your judgment.

When short-selling in a volatile market, it’s important not to trade too aggressively. Trade orders, like stop-loss orders and take-profit orders, can keep trades within a comfortable range of gain and loss. Define your goals as a comparative percentage to your current holding. For example,

“my goal is to turn a 10% profit on my ETH worth $100”.

Refine your short-term trading strategies

After determining your profit target in a percentage, you can also sell your positions in parts. For example, you could sell one-third of a position when the value increases slightly, and hold the rest to wait for a better opportunity. If it doesn’t come, you will have still made a small profit.

You can also use a tighter trailing stop. A trailing stop is a type of stop order set at a different percentage or price than the security’s current market price. A trailing stop set at a lower price keeps a trader’s position open for longer, while a higher price keeps it at a short position. Though day trading works best for volatile exchanges, there are times you won’t be able to monitor your trades. Other trade orders should be used on every exchange.

Analyze and target market trends

Keep your focus on cryptocurrencies that are trending in the market. Try to find crypto which is trending upwards, wait for volatility to strike, and get into the sale just before the value accelerates. Though there is a risk of a fast decline, getting your timing right by placing trade orders will lead to a faster profit.

Buy at the breakout

Think of the price movements of your crypto as a 2D fish swimming through water. It can swim lower or higher, and change direction quickly. When the fish swims closer to the surface (or the breakout) fishermen grab onto it and pull it even higher.

This fish is a cryptocurrency that traders are not aware of yet or for whatever reason, are resistant to buy. Once it hits the upside, traders may lose their resistance to buy and rapidly invest. Selling during this frenzy and leaving before the breakout loses momentum is a great method to turn a profit safely.

Keep updated on new information

Staying informed on the newest market developments is crucial. Make sure that the notifications on your financial applications are turned on. Review new data before making trading decisions, and search for the latest articles on the cryptocurrencies you have holds in. Lastly, use a volatility indicator to track market movements.

What Is the best volatility indicator for crypto Markets?

Several volatility indicators can be used specifically for cryptocurrency. They include:

CVI (Crypto Volatility Index) Chart

This is a decentralized volatility index that can be customized for crypto traders to use. It’s publicly available, updates in real-time, and allows users to hedge against impermanent loss. Created by Professor Dan Galai, you can use it to monitor the volatility of USDC and ETH.

Bitcoin and Ethereum Historical Volatility Index

The BitVol Index and EthVol Index provide measurements of the expected 30-day volatility of bitcoin and Ethereum respectively. They are both derived from historical data on their tradeable options. The fear gauge shows data from 2020 onwards and can be used to analyze trends in crypto prices.

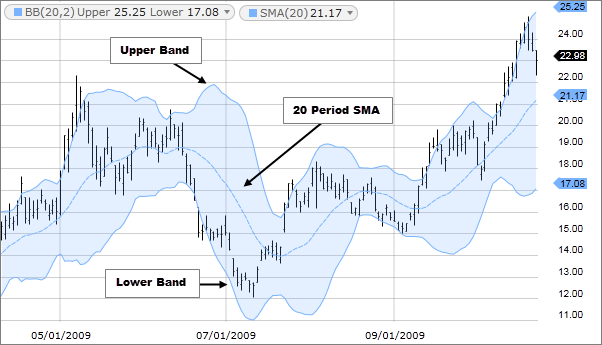

Bollinger Bands

This fear index is popularly used by crypto traders not just to indicate volatility, but to search for the entry and exit points. This makes it a wonderful index to use when looking for breakouts to buy into. Created by John Bollinger, the index uses three lines (or bands) to display the moving average alongside positive and negative deviations. This unique display makes it easier for crypto traders to determine market trends, and which cryptos have been overbought or oversold.

What time is crypto most volatile?

Cryptocurrency is open 24/7, unlike traditional stocks. This means volatility can strike at any time. However, volatility tends to happen between 8 am and 4 pm local time so if you are a crypto trader, you can probably find the most opportunity there.

Speaking of finding opportunities, YouHodler provides you with the tools to capitalize on volatility. We have numerous features that help you long or short the market, multiplying your crypto up to x50 in the process.

Our popular features like Multi HODL and Dual Assets allow you to “play” with your crypto in both bull and bear markets. The more volatility there is, the more opportunities there are for you to earn interest as high as 365% and multiply your crypto.

Don’t just HODL through the volatility. Take action and try and make something from it. Head to YouHodler.com today or download the mobile app to see how we help you activate your crypto.