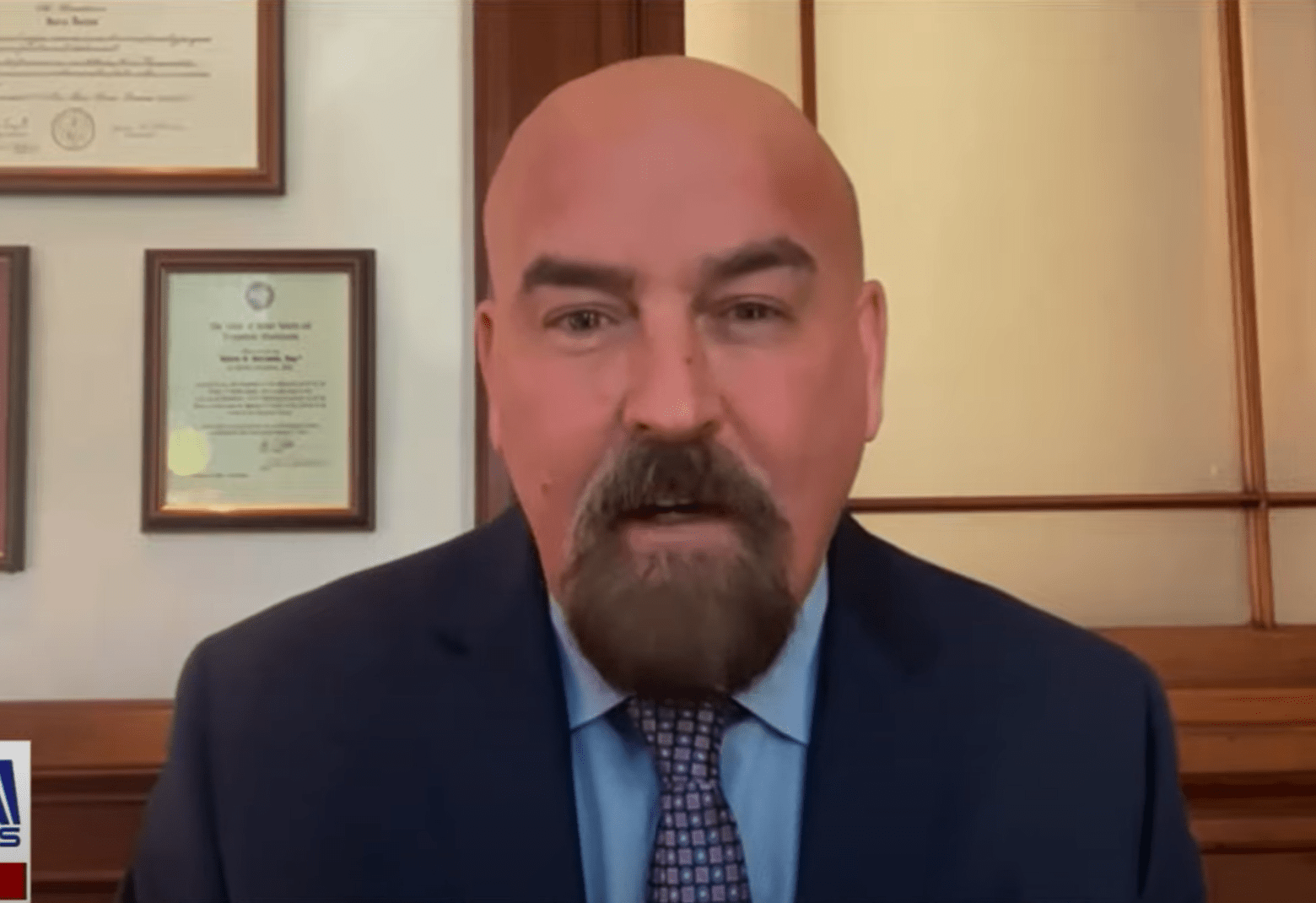

In a scathing critique of the US Securities and Exchange Commission (SEC), renowned pro-XRP lawyer John E. Deaton has unleashed a broadside against what he perceives as systemic corruption, favoritism, and a glaring double standard in the regulatory oversight of cryptocurrencies. Deaton’s fiery response, articulated through via X, was triggered by a commentary from his colleague, James “MetaLawMan” Murphy, regarding the SEC’s recent hearings involving major crypto exchanges Coinbase and Binance.

Murphy’s initial observation pointed out a significant omission in the SEC’s narrative, “The SEC touted the benefits of the guidance it had given about how to analyze whether crypto tokens are securities. Yet, they omitted any mention of Bill Hinman’s invention of the ‘sufficiently decentralized’ test. As if it never happened.” This alleged inconsistency set the stage for Deaton’s vehement response.

Pro-XRP Lawyer Unpacks Ethereum ‘Free Pass’

Deaton’s statements, although devoid of direct names, were clear in their targets for those well-informed. With a tone of irrefutable conviction, he didn’t mince words in his analysis. “If people haven’t figured it out by now, let me help you: the speech [the Hinman speech] was a pure money grab – nothing more, nothing less,” he tweeted.

He asserted that the essence of the issue transcends the technological merits or the ecosystem of Ethereum. “Whether you believe in ETH or whether Ethereum is a great technology or ecosystem, is not the point,” Deaton affirmed.

He further contended that had the SEC pursued legal action against Ethereum, Consensys, Joe Lubin, and Vitalik Buterin, alleging that ETH was a security, his reaction would have mirrored the legal stance he took in defense of XRP. “As I’ve said before, had the SEC sued Ethereum… instead of Ripple, Brad Garlinghouse & Chris Larsen, I would’ve sued the SEC just like I did over XRP,” Deaton stated emphatically.

Deaton also drew attention to the SEC’s conspicuous silence on Ethereum, highlighting a notable pattern of avoidance both before and after the Hinman speech. This pointed observation raises unsettling questions about the SEC’s impartiality and thoroughness in its regulatory oversight.

“Prior to the speech being given, the SEC 100% refused to discuss any particular crypto token. Since the speech, the SEC has 100% refused to discuss any particular crypto token, including ETH. Why hasn’t there been an investigation?” Deaton questioned, suggesting a lack of consistency and transparency in the SEC’s approach.

An Era Of Govt Corruption

Deaton’s critique goes beyond the crypto industry, painting a picture of a broader systemic issue he terms the “Corruption Era.” In this era, as portrayed by Deaton, a pervasive disregard for ethical standards and conflicts of interest is not just prevalent but expected. He draws parallels with various high-profile incidents, suggesting that the alleged “Ethereum free pass” is symptomatic of a larger, more deep-rooted problem.

For instance, he points to the alleged actions of members of Congress, “An era when Congress exempts itself from insider trading laws so that members of Congress, recently briefed about a pandemic and a government shutdown, can use that non-public information and cash out of the stock market before it crashes, making hundreds of thousands of dollars.”

He doesn’t stop there; Deaton also cites the controversial dealings involving Nancy Pelosi, “An era when the Speaker of the House presents a Bill on the House floor favoring credit card companies, like Visa, and then shortly thereafter, the Speaker and her husband are offered millions in Pre-IPO shares of Visa, not offered to the public, making millions of dollars.”

The critique also encompasses actions by Hunter Biden and Donald Trump, highlighting what Deaton perceives as blatant misuse of power for personal or familial gain, “An era when the Vice President of the United States uses his office and position to secure millions of dollars for his son and his family, but deny it to the American people when running for President.”

Furthermore, Deaton points to the dealings of Hillary Clinton and Dr. Scott Gottlieb, suggesting a pattern where positions of power are leveraged for personal benefit or in service of special interests, “An era when the Secretary of State has a foundation that accepts donations and money from foreign countries and foreign nationals while she is Secretary of State, and meeting those donors in her official capacity for the United States.”

XRP Price Drops Further

At press time, XRP traded at $0.52335, down 16% in the last 12 days.

Featured image from YouTube, chart from TradingView.com