Ripple seems to be paying more attention to macro-financial factors and less attention to short-term price fluctuations these days.

An executive statement that emphasizes this shift suggests that Ripple is focusing on the international cross-border payment market. As a result, the active drop in XRP price is almost finished, but the altcoin lacks the necessary positive momentum to start a rebound.

With its payment solutions that use XRP for cross-border settlements, Ripple hopes to take a piece of the rapidly growing payment market, which is expected to reach $300 trillion by 2030.

Ripple Makes Foray Into International Payment Market

According to a recent Grayscale research, Ripple’s approach entails streamlining the intricate global payment network. The organization wants to offer cross-border transfer methods that are more transparent, cost-effective, and efficient.

The market is anticipating an increase in Ripple’s XRP value due to this strategy. Experts are projecting a 5,000% increase, which might cause the price to surpass $25.

At the time of writing, XRP was trading at $0.622, up 0.13% in the last 24 hours, and tallied a minor 2.84% increase in the last seven days, data from crypto price tracker CoinMarketCap shows.

Head of Payments Product at Ripple, Pegah Soltani, has provided insight into how the San Francisco-headquartered startup plans to apply blockchain technology to address current industry challenges.

“Global Payments”

Pegah Soltani

Head Of Payment Product #Ripple #XRP #Ripple#XRP pic.twitter.com/NAomIPn73o— MetaMan X ™️ (@MetaMan_X) November 20, 2023

During the lecture, Soltani underscored her fascination with the substantial volume of financial transactions occurring across international borders, which reaches trillions of dollars on an annual basis.

Soltani observed that some sources anticipate a substantial increase in this value, projecting it to reach an impressive $300 trillion by the year 2030.

An important facet of Ripple’s approach is the XRP-Xahau Burn2Mint (B2M) function. This creative method makes it possible to exchange XRP tokens for XAH, the native coin of Xahau.

XRP market cap reaches $33.2 billion on the weekend chart: TradingView.com

This technique enhances the efficacy and robustness of the XRPL ecosystem through the enhancement of transaction security and seamless integration with decentralized networks.

By making it easier to integrate with decentralized networks and bolstering the security of transactions, this technique makes the XRPL ecosystem more valuable and secure.

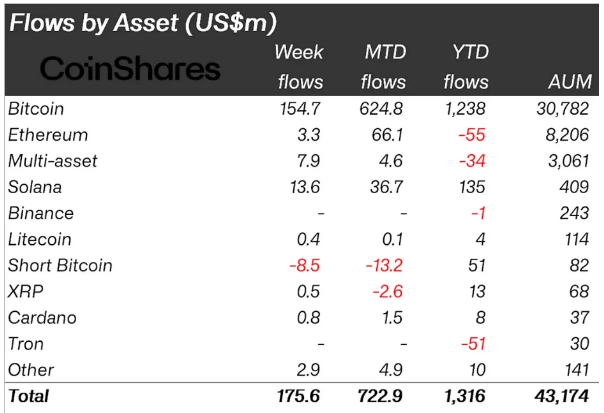

The current state of XRP’s ownership by institutional investors is significant. According to the CoinShares report, XRP received over $500,000 in investments recently, bringing its total monthly inflows to $17 million.

Source: Bloomberg and CoinShares

As a result, the cryptocurrency has made nearly $70 million since the start of the year, a far larger amount than any of the other assets on the list, including Cardano and Tron, and others.

The progress that Ripple is making could pose a serious threat to established systems such as SWIFT, indicating a move in the direction of a more user-friendly and effective global banking system.

Therefore, the trajectory of Ripple in the financial industry merits careful scrutiny as it has the potential to rethink processes of international finance.

Featured image from Freepik