Have you ever heard an investor or trader declare they’re “long” or “short” a cryptocurrency? This is not just jargon but an important part of investment strategy. Understanding the distinction between a short position and a long position can assist crypto traders in making better-informed investment decisions in all market conditions.

What is a stock position or a crypto position?

To understand a short position vs a long position, we must first define what a position is.

Size and direction define a position. This means that your position can change based on how much of an asset you own and whether you are purchasing or selling it.

In both stock and cryptocurrency trading, a position actually has the same meaning. It is the statement of a market commitment held by a trader who can either make or lose money. In other words, a position is a terminology for whether the investor believes the stock or cryptocurrency prices will rise or fall. A position can also refer to the amount or size of an asset and investments that you hold or have sold short.

Determining position is essential in trading. Without knowing which position to take, you might lose the opportunity to gain profits from market fluctuations or even face unpredictable losses in the future.

There are two terms related to positions that are also often used by investors:

- An open position

- A closed position.

When you own $500 shares of a stock, it means that you have an open position in that stock. It becomes a closed position when you sell those $500 shares. Profit or loss can only be determined once the transactions are completely closed.

Long and short position meaning

There are two main types of positions:

- Long positions

- Short positions

You gain profit from long trades when the crypto increases in price. In contrast, short trades profit when the crypto involved decreases in price. Long trades are commonly called being bullish on an asset, while short trades are often called being bearish on an asset.

Investors and traders can establish both long or short positions in any type of cryptocurrency on the market.

What is a long position?

A long position is when an investor purchases an asset with the assumption that the asset’s price will rise in the future. As a result, asset purchases are done with the intention of profiting without planning to sell it in the near future. This type of position only requires you to have enough money for purchases, broker commissions, and other fees.

Long position example

For example, you expect Bitcoin to increase in price and decide to buy 2 BTC at a purchase price of $30,000 per bitcoin. This is a total price of $60,000 (2 X $30,000). Hence, this means you’re “going long” on 2 BTC.

When BTC increases to $60,000, then you get a 100% increase in the value of your BTC. If you decide to sell both right away, then you get a $60,000 profit from the difference ($120,000 – $60,000). However, if you sold BTC when the price fell to $20,000 then you generate – 33.3% in losses.

What is a short position?

Short positions, in contrast, are when an investor or trader believes that the price of an asset will fall in the future and looks to make money from the price decrease. They will use a specific technique to try to profit from this situation. One of the most common short position techniques is short selling. Compared to a long position, a short position is slightly more complicated for beginners.

Basically, short selling is a strategy where you sell crypto you don’t own and plan to buy them back later for much lower prices. In general practice, you have to borrow shares of a stock you think will fall from an investment bank or other financial institutions.

Short selling example

To short the BTC, you would need to borrow Bitcoin from your broker. Let’s say you want to borrow 1 Bitcoin at a price of $30,000 and short-sell them for $60,000. This leaves you with 2 bitcoins to short.

Once you sell the Bitcoin, the price drops just as you predicted to $20,000 per coin. Now, you can repurchase those 2 bitcoins for a total of $40,000 meaning you made a profit of $20,000 and you get your Bitcoins back.

According to the explanations above, you may be wondering why don’t we just use ‘buy’ and ‘sell’ terms to describe short position vs. long position since it simply involves a buying and selling process.

As the term suggests, by using short and long positions, investors now know their position or mindset toward their assets, so they don’t just buy or sell things without any plausible projections.

Short position vs. Long position: what is more beneficial?

Both short positions and long positions come with certain elements of risk – more on that later. But overall, short positions are more alluring. With short positions, traders can profit even if the price goes down, adding another tool in a trader’s arsenal for every market condition.

How to manage short-position and long-position risk

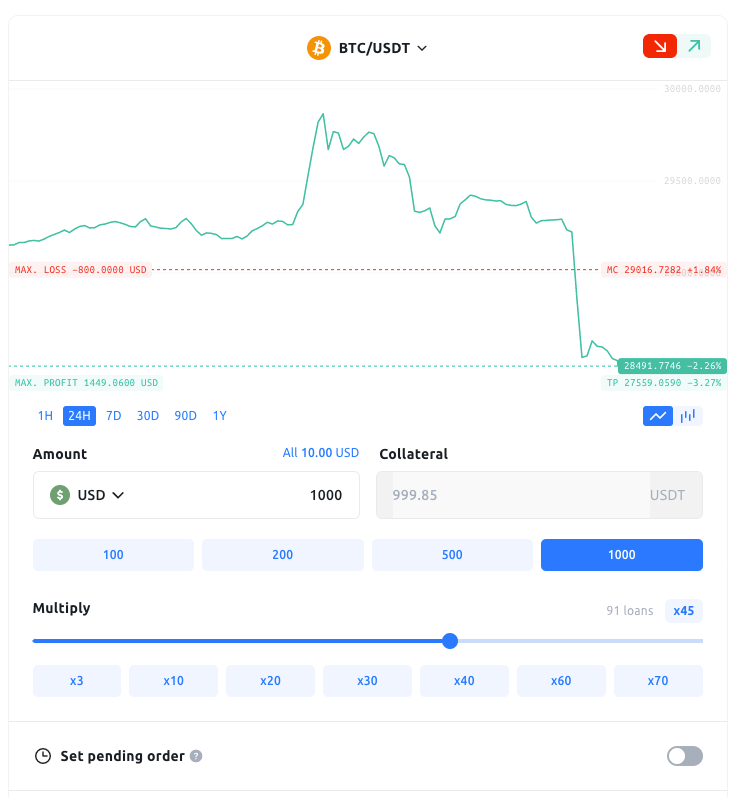

YouHodler’s MultiHODL feature helps you mitigate risks with the Take Profit and Stop Loss tools. As seen in the picture above, all a trader has to do is input a price point for Take Profit or Stop Loss.

This then automatically closes your short or long position so you have more control over your exit strategy. Exiting a position manually is risky, as the crypto market is volatile and can change when we are not monitoring it. We recommend always setting Take Profit or Stop Loss when longing or shorting cryptocurrency.

Using short positions and long positions simultaneously

The good news is, you don’t always have to choose between the two.

You can mitigate your risk by using short and long positions simultaneously. This is due to the fact that your short position serves to balance any losses from your long position.

This method, also known as hedging or lock trading, is widely used in futures trading.

PRO TIP! You can open up crypto short and long positions at the same time using MultiHODL.

CLICK HERE to read more about it.

Typically, traders will hedge when it is too difficult to predict market direction.

Hedging is better suited for those who trade for a living rather than for fun. They are generally typically well-established in the area and have extensive market expertise.

Conclusion

Short and long positions are important tools for any crypto or stock trader. While there is still a stigma surrounding them, especially short positions, traders should realize that these tools can help them capitalize on volatility regardless of market conditions.

Both bull markets and long, cold recessions offer profitable opportunities in the crypto market. Short positions help you capitalize on falling prices of an asset while long positions help you capitalize on rising prices. At any given moment, prices are either rising or falling – or both simultaneously. Hence, opportunities exist every day.

YouHodler’s trading tool MultiHODL makes longing and shorting crypto easy as ordering a pizza on your phone. All you need is some crypto, knowledge of the market, and the YouHodler app. Of course, the risk is always there for any investment or trading opportunity. But for those that mitigate risks effectively, new opportunities arise.

Disclaimer: The content should not be construed as investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is made available to you for information and/or education purposes only.

You should take independent investment advice from a professional in connection with, or independently research and verify any information that you find in the article and wish to rely upon.