It’s impossible to watch all facets of the market simultaneously and react in real-time. Thankfully, there are several tools to help traders capitalize on the various ups and downs of the stock market.

In this guide, we’ll explain the primary stock order types and how they work in detail. Learning some terminology from traditional stock markets can even help you in your crypto day trading career.

Market Orders

A market order is one of the most common stock order types. It’s a basic order to buy or sell an asset that instantly goes live. This means you can start receiving or giving offers for the asset immediately. Market orders usually result in a transaction near or at the asking price.

For example:

- If you’re the one selling the asset, you’ll receive bids from other traders.

- If you’re buying, you can submit an ask for the market order.

However, the transaction price you end up accepting may differ from the price listed on the order. This is because the market price might change between the time the order is posted, and when it’s executed. Thus, the bid you receive or send may be slightly higher or lower.

Market orders are perfect for selling or buying assets without any delay, and you’re likely to fulfill the trade close to the market price.

Limit Orders

Limit orders are a type of pending order that allows traders to sell or buy assets at a future price. Traders place these orders when they expect market prices to rise. There are two types of limit orders:

- Buy-limit

- Sell-limit

When to use a buy-limit order

Traders use a buy-limit order to buy assets at a lower price than the current market price. When traders expect an asset price to rise momentarily, they can use this order to buy it below market price. Then, they can sell it when the price is at its peak.

When to use a sell-limit order

To sell at an appreciated price, traders use a sell-limit order. When traders expect their assets to fall in price again, they can set this order to execute at a rising market trend. Traders can make a quick profit by selling just before a price drop.

These two limit orders are powerful to help traders take advantage of short-term market price volatility. They also reduce the risk of loss by selling and buying at prices within the trader’s capabilities.

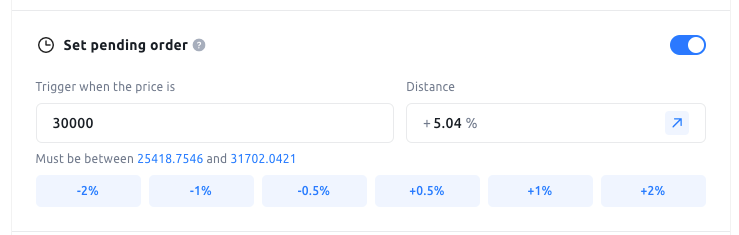

Pending Orders

Pending orders are set to execute at future market prices and rely on slippage conditions. Slippage is the difference between the price the trader sets and the transaction price. There are two types of pending orders, stop and limit orders. We’ve explained limit orders above, so let’s look at how to trade with stop orders.

Pro tip! Did you know you can use Pending Orders on YouHodler with MultiHODL? It combines all of the above in one, easy-to-use feature.

Read about it in the article below!

Suggested reading: How to Trade with Pending Orders on YouHodler

How to trade with stop orders

Traders use buy-stop orders to buy assets at a higher price. This is with the expectation that the deposit will keep increasing in price, becoming more valuable in the trader’s possession. Sell-stop orders sell at a lower price, and help traders minimize their losses. With this order, the trader expects the assets to continue to decline in price – selling them sooner is a risk management strategy.

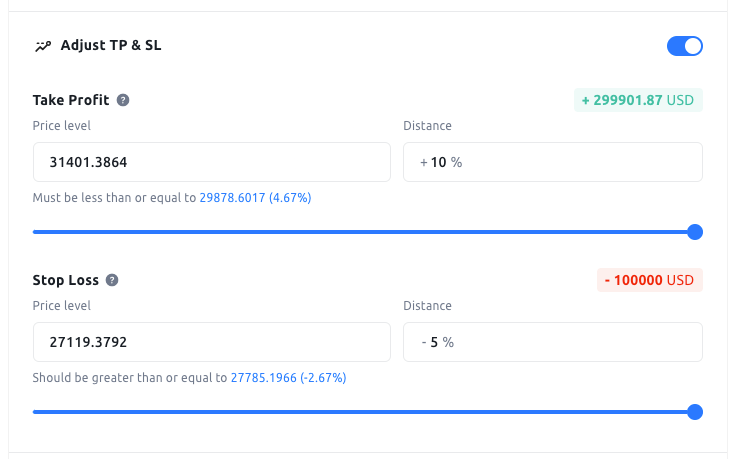

Stop-Loss Order

The stop-loss order is true to its name, as it’s used to limit a trader’s loss on a certain position. To control risk, traders set their assets to sell at the stop price; a depreciated value. Unlike stop-limit orders, which aren’t guaranteed to execute, stop-loss orders always will. As long as there are willing buyers or sellers for the asset, the order will proceed.

Traders usually use this order to protect a long position, as the risk of price volatility increases the longer you hold. However, it can also protect short positions from sudden price drops. A trader might calculate a stop price at 5%, 10%, or 15% below the current level.

Once the asset’s value reaches a lower value, the stop-loss order is automatically executed. A transaction is made at the quickest opportunity and for the closest price. Traders can pair a stop-loss order with a trailing stop, set at a percentage below or above the current price. This makes the order more flexible by allowing you to lock in a profit if the market price moves up. If it moves down, the order will protect you from downside risk.

Take Profit Order

A take-profit order is a type of limit order that traders often use in conjunction with stop-loss orders. While the stop-loss order limits loss, a take-profit order locks in gain. It is especially useful for traders who want to maximize their profits on short-term investments. They are executed at what the trader predicts is the best possible price within a period.

Using a risk-reward ratio, a trader can determine what profit goal and loss risk they’re comfortable with. This is done by comparing two ratios: the price you paid for the assets and the greatest risk or loss. The second is the transaction price again, and the biggest reward, which will set the take-profit price.

Take the profit order example

Let’s say that you predict Bitcoin (BTC) will rise to $31,401 and you bought it at $28,562. To make sure you sell at that exact moment and not later when BTC drops below $28,000 again, you can set a Take Profit order. This ensures your position closes exactly at the price you want, locking in your profit automatically.

This saves you time watching the market and of course, saves you money from unexpected volatility.

You can apply the same principles to Stop Loss. If you set the stop loss at $27,000 for example, then you lock in your losses and ensure you don’t lose further money on your deal if Bitcoin drops further than 5%.

These tools work best during smaller market fluctuations, helping you open several positions in one day and achieve short-term profit.

PRO TIP! MultiHODL has to Take Profit and Stop Loss tools to help you manage your crypto trades effectively. Plan your exit strategies and mitigate risk with Take Profit and Stop Loss. Give it a try today!

Conclusion

These stock orders function as valuable tools for any trading strategy. Their value is maximized when the correct orders are used in conjunction, and their advantages are crucial. Stock orders reduce risk, create profit opportunities, and lessen impulsive decisions. They allow day traders to live more productive and less stressful lives, without having to constantly manage their trades. The five stock orders explained in this guide ensure a trader’s assets are protected for any situation.

Give it a try on the crypto market today.

Disclaimer: “The content should not be construed as investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is made available to you for information and/or education purposes only.

You should take independent investment advice from a professional in connection with, or independently research and verify any information that you find in the article and wish to rely upon.”