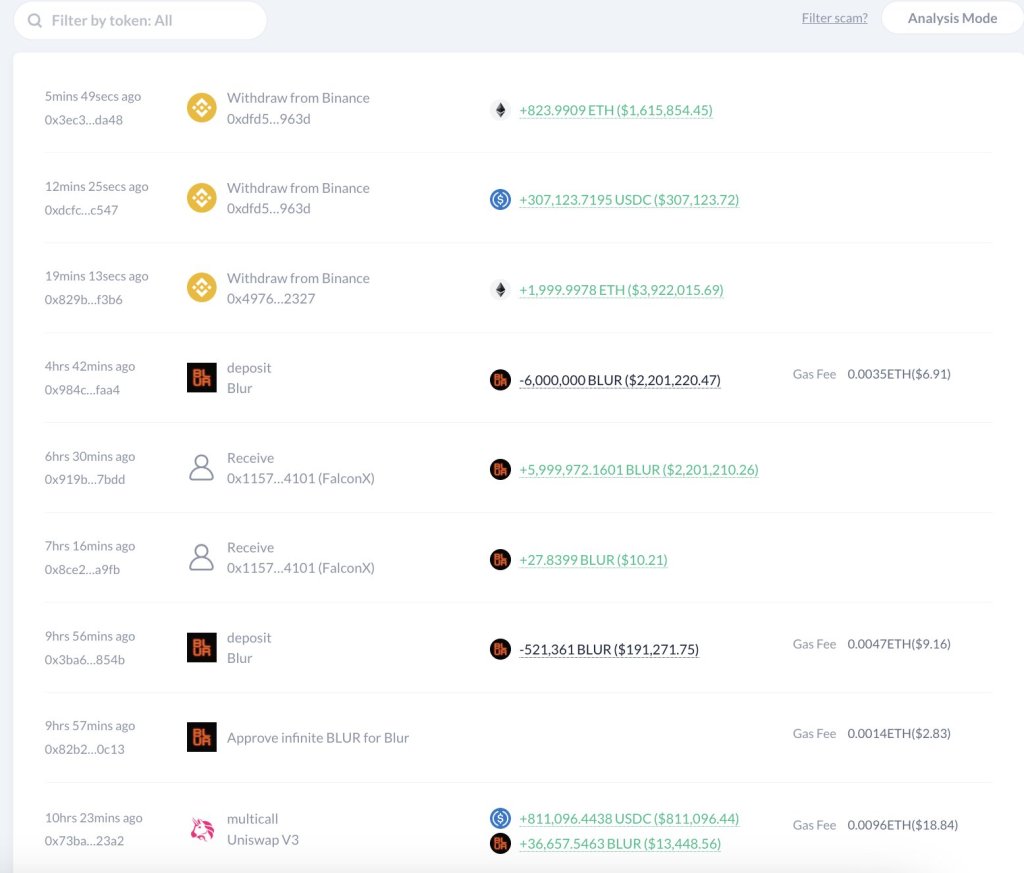

According to on-chain data platform Lookonchain, an unnamed crypto whale known for well-timed Ethereum (ETH) trades in the past, has purchased an additional $5.53 million worth of ETH on Binance amidst turbulent market conditions.

Ethereum Whale Ramping Up Purchase

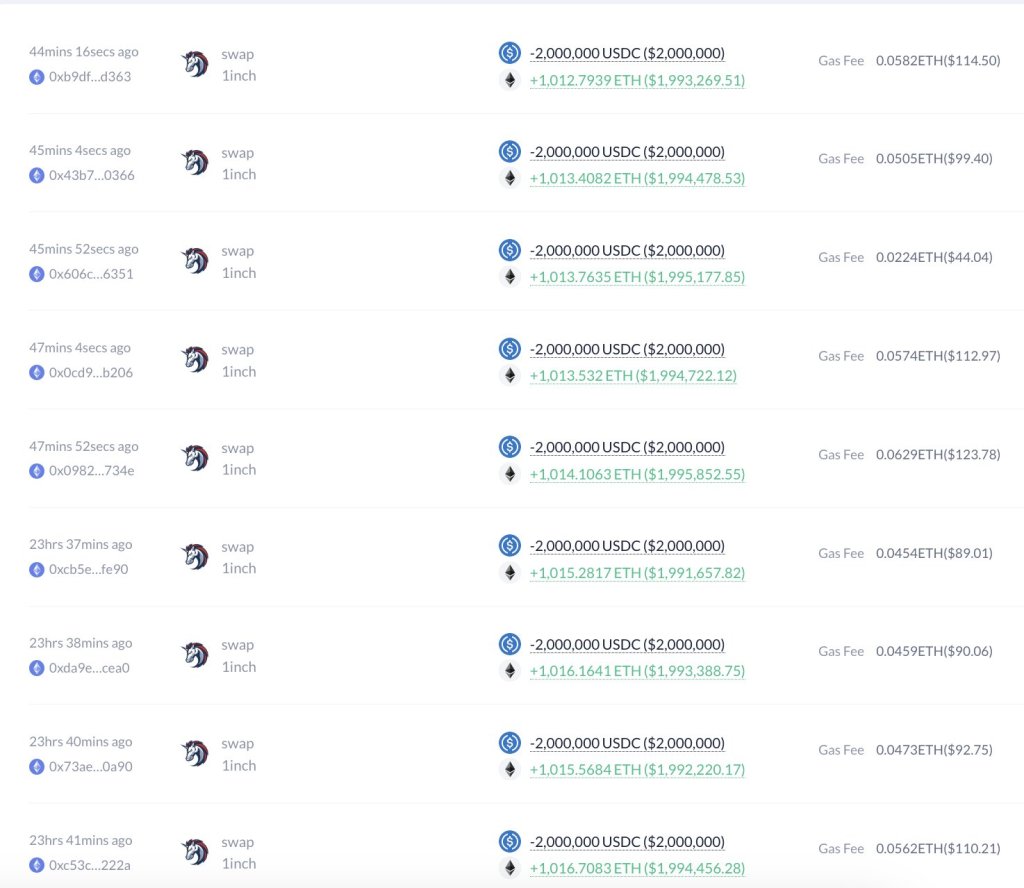

According to an X post on November 22, the purchase follows an acquisition last week when $18 million of USDC, a stablecoin, was used to acquire ETH at around $1,971. With the whale appearing to ramp up ETH purchases, Lookonchain speculates that the same trader is positioning for an upcoming ETH breakout past the stubborn $2,100 resistance level that could signal a renewed bull market.

It should be observed that despite recent expansions in ETH, the $2,100 level remains a crucial reaction point for traders. The only time prices flew above this level was in late July and early November 2023. Prices continue to edge higher when writing but remain below the liquidation line.

Binance And Changpeng Zhao Settle With U.S. Authorities

The Ethereum whale is doubling despite news that the U.S. Department of Justice levied over $4 billion in fines against Binance related to regulatory violations – leading to founder Changpeng Zhao resigning as CEO on November 21. According to reports, the founder will pay $50 million as a settlement with U.S. authorities.

While the penalties briefly caused crypto prices to falter, markets have since stabilized, with ETH prices recovering around 5% recently toward $2,100. Based on this, more upside could emerge if the whale trader’s prognosis proves correct in time.

Meanwhile, BNB, the native currency of the BNB Chain and used to incentivize trading on Binance, remains under pressure but relatively firm. The coin has failed to reverse losses of November 21, but losses have been contained on November 22.

From what has panned out in the past two days, some experts now suggest the Binance settlement brings validation that permits established coins like Bitcoin to become entrenched and resilient enough to weather legal storms. To illustrate, though the DOJ penalty triggered liquidation among altcoins, Bitcoin appears largely immune, trading above $36,500 but below the $38,000 resistance level.

Beyond this, Paul Tuchmann, a former United States prosecutor and partner at law firm Wiggin and Dana, believes that Binance is now too big to fail since the DOJ issued a deferred prosecution agreement, effectively cushioning innocent shareholders, clients and others associated with the exchange from bearing the full brunt of this ruling. With this agreement, the exchange will pay the fine over 15 months.

Feature image from Canva, chart from TradingView