Cryptocurrency trading is a risky business, but trade orders can make all the difference. You don’t want to waste hours staring at your screen for market fluxes. Even with years of experience and hours of research, confidence is hard to come by.

Take-profit orders exist to lock in that confidence by minimizing risk. Any beginner or intermediate trader can learn how to use a take-profit order. Being able to set one properly will enhance your skills as a trader. Setting the right trade order at the right time can only set you up for success.

A take-profit order has a distinct purpose; we will define how it differs from other trade orders. We will also give a simple explanation of the steps of setting up a take-profit order. Read on and discover exactly how to prepare your crypto investment for opportunistic growth.

Take Profit Order vs. Stop Loss Order

A take-profit order is a type of trade order. There are various types of trade orders, such as a stop-loss order. Both of these fall under limit orders.

This means that both will set a term (usually a change in price) on an investment. If the condition is met, the investment will be put into a closed position. A market order will go out for the cryptocurrency, and be sold at the price you set.

Suggested Reading: Stop Loss Order Explained

These two trade orders are often used together to keep a trade safe and profitable. One maximizes profit and one minimizes loss. They are opposite in definition but work well together. However, they are often confused as being in the same order. Let’s look at how these orders differ from each other.

The major difference between them is in their purpose. A take-profit order is set up to maximize short-term profits on crypto investment. It does this by setting up a trigger price. For a take-profit order, the trigger price will always be higher than what the trader first paid. This means a trader will always sell at a profit, no matter the initial price.

A stop-loss order has a different purpose. It minimizes the loss a trader would experience from an investment. The trigger price is lower than what the trader bought the crypto for.

When using a stop loss order, you consider how much loss you’re willing to take on an investment. Then, you set the trigger price and the amount you want to sell. Therefore, placing an open market order for that crypto at a specific price.

You can also use a stop-loss order to buy another crypto. For example, let’s say you have a cryptocurrency valued at $50 per coin. You’re confident that the price of your crypto will rise in the future. You want to invest at a lower price than that. Hence, you set a stop-loss order lower than the current value (e.g. $40). If the crypto’s value drops to $40 even for just a moment, you automatically trigger the buy and get your investment at a discounted rate.

After that, you can set up a take-profit order at the price of $60. When the price of your investment goes up to $60, your order is triggered and you automatically sell at that price. Buying at $40 and selling at $60 generates a 50% profit, all thanks to these trade orders.

Lastly, there is a stop-loss order. If you set the trigger price at $35, then the order automatically sells your investment at that price. So, if the price drops even further to $20 for example, it means you exited the market before experiencing further loss. This combination of limited orders ensures you have a lock-in for future profits. It also helps to define your risk ratio. You will know what to expect from your investment, whether the market value drops or rises.

How Does a Take-Profit Order Work?

First, set your take-profit expectations via a risk-reward ratio. You can do the same to determine a good stop-loss order. This determines your risk expectations and your profit goal.

A risk-reward (or risk-return) ratio is the difference between two ratios. The first is the price (that you paid) and the greatest risk you expect (the stop-loss price). The second is the profit you expect (the take-profit price) and the price you paid again. These two figures are then divided from each other.

Research the cryptocurrency before you decide to invest. By knowing its previous trends in price, you can get a more accurate risk-reward ratio. For short-term profits, you should expect a reasonable percentage rise in value.

Suggested reading: Crypto watch: Best Cryptos to Buy in 2022

We’ve already provided a short example of how the take-profit order works. Its trigger price is set above the price paid for the initial investment. This locks in a concrete profit on the crypto. The take-profit order is the most popular for day traders.

As a day trader, you have limited time to watch your investments. The take-profit order helps a trader potentially make a good profit off market volatility

Try to stick with rounded numbers when setting your trigger price. These could be $60, $65, $70, and so on. These are where most traders place their conditional trade orders. Traders will experience the most loss or profit around these numbers. These numbers represent the levels of resistance a cryptocurrency will reach. At a level of resistance, the cryptocurrency value becomes more likely to fall or rise.

The Good and Bad of Take Profit Order

There are advantages and disadvantages to any trade order. Let’s review the pros and cons of a take-profit order.

Advantages

Good for Quick Profits

Take-profit orders work great for traders using short-term strategies. If the price fluctuates quickly, a day trader can still make a quick profit. Over time, many small profits add up.

Minimizes Emotional Investment

As a trader, you might develop a personal interest in the success of a trade. This can lead to extra stress and second-guessing. By setting up a limit order, you can rest without worry. You already accepted your selling price and the profit.

Sets Expectations

It’s important to set your expectations of a trade. This Keeps you from making emotion-based decisions. It also helps set a precedent for future trades. You can be confident in the daily, weekly, or monthly profits you make.

Minimizes Risk

Your take-profit order minimizes risk with the risk-reward ratio. You can use other risk management strategies in tangent with the order. Regardless, this short-term strategy closes you to further risks. The market may fluctuate rapidly. Beyond the trigger price you set, it won’t affect your investment.

You can even set more than one take-profit order on one cryptocurrency investment. If you buy in at $50, your first take-profit order can be for $55. You can set it to sell only 20% of your investment.

The next week, you can set another for $60. This can also sell 20% of the original investment. You can do this until you have made a sum of profits over several weeks.

Disadvantages

Not for Long-Term Strategies

Take-profit orders activate when the market value reaches the trigger price. It ignores other fluctuations. A long-term trader can’t use it for a goal in the distant future. A long-term trader can tolerate more ups and downs in the market.

Ignores Trends

There are cases where a cryptocurrency steadily increases in price. This is a trend that a take-profit order would ignore. You can set a take-profit order that executes at the trigger price. If the price keeps increasing, though, you would have missed out on extra profit.

Doesn’t Guarantee Execution

You have to be smart with your take-profit orders to receive as much profit as possible. No matter how sound your trigger price is, though, a profit isn’t guaranteed. Unexpected fluctuations in the market might see the cryptocurrency only lose value.

Hence, your trigger price is never reached. If so, you lost profit. This is why using a stop-loss order on trade is important.

What’s the Best App for a Take Profit Order?

If you made it this far in the article, you’re one of two things: either very confused or intrigued. The true trading experts probably left the first paragraph when they realized they knew all this information already. So now that you’ve made it down to the end, you probably want to realize how to put this new information into practice.

Well, on traditional trading instruments, setting a take-profit order can be a bit complicated and time-consuming. We encourage you to try but before you do, why not start with YouHodler’s Multi HODL feature?

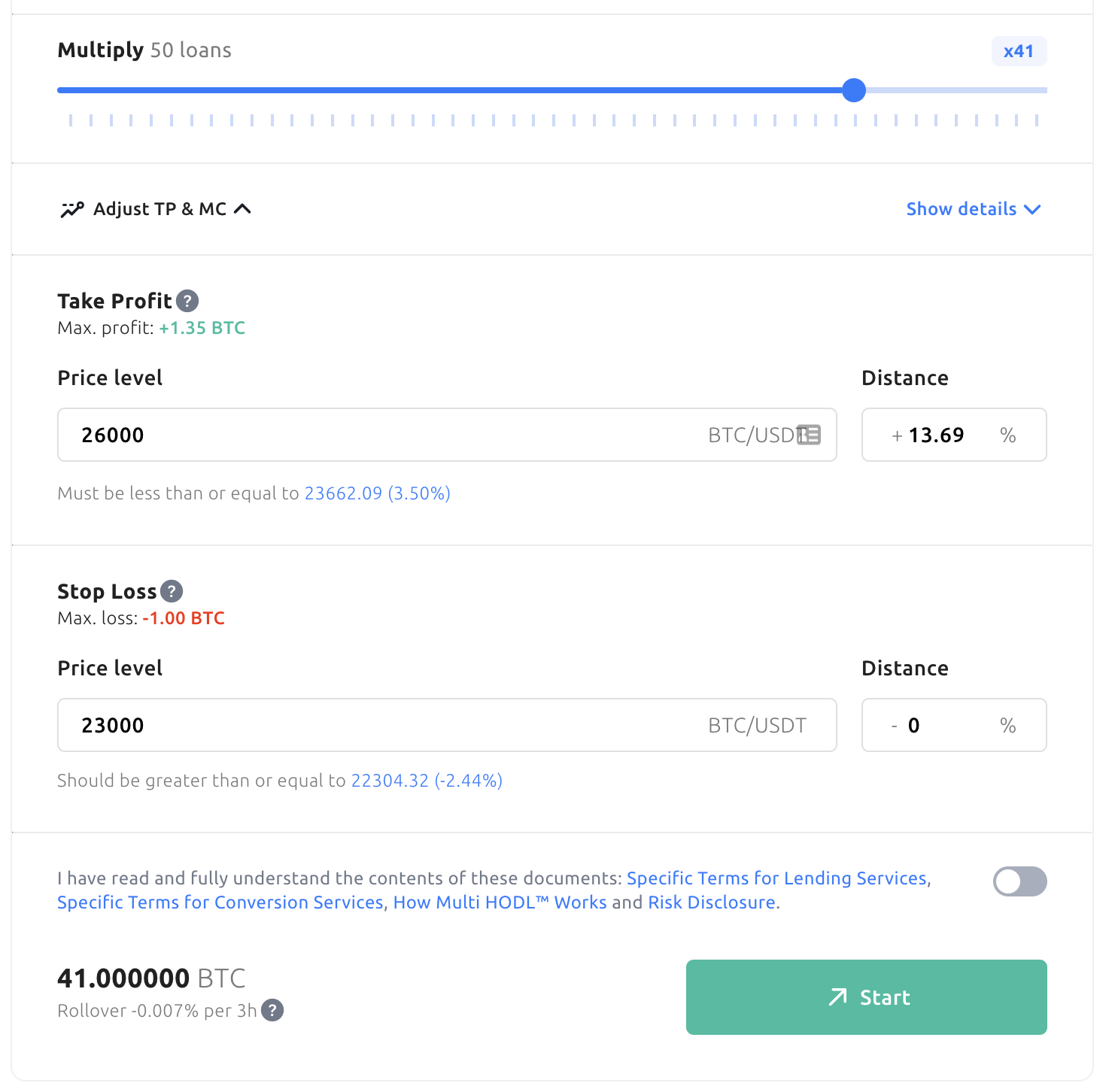

On Multi HODL you can set your take profit price for any crypto on the platform. Multi HODL is an automated trading tool that helps you long or short crypto with multiplier levels up to x50. It allows you to multiply your crypto as professional traders can but with a user-friendly interface and additional risk management features like take profit.

YouHodler’s app is available for Android, iOS, and online at YouHodler.com. So give it a try today and test out your trading skills.

Frequently Asked Questions About Taking Profit Orders

What is a limit order vs a take profit order?

A take-profit order is one kind of limit order. Other limit orders include buy-stop, sell-stop, and stop-loss. A limit order sets a term for a future trade. This term is usually a trigger price. A take-profit order closes an investment position when it fulfills the term.

When should I take profit?

It depends on your goals as a trader. Some will set their profit expectations as low as 5%. Others will aim for 50% profits. Watch the trends of your cryptocurrency investment. If it increases steadily by over 30%, you can start to take-profit.

Do this by setting take-profit orders for a small amount of your holding. You can sell 5-10% or more at one time. As the price continues to rise, you will continue to make a profit.

“The content should not be construed as investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is made available to you for information and/or education purposes only.

You should take independent investment advice from a professional in connection with, or independently research and verify any information that you find in the article and wish to rely upon.”

Disclaimer: “The content should not be construed as investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is made available to you for information and/or education purposes only.

You should take independent investment advice from a professional in connection with, or independently research and verify any information that you find in the article and wish to rely upon.”